Better

Deals

Welcome to the deal table. What are we doing here?

In theory, we each have something to trade, something that the other may value more than what we already possess. Ideally, by trading, we are both better off. At Permanent Equity, we are usually trading money for 51-100% equity ownership positions in private companies.

Trades, big and small, are made daily. And for some frustrating reason, we are conditioned to believe that the other party wants us to lose as much as we want to win. This stance naturally makes us defensive and obsessed with what we’re giving and receiving. Above all, we cannot lose.

Not losing is one of the most baffling issues with human rationality. With rare exception, you are at the table of your own free will. And oftentimes, if the parties work together, the outcomes can be improved for everyone — sometimes by orders of magnitude. But we are so afraid of the other party not cooperating, we restrict our collective interests to preserve our self interest.

It’s not your fault; you biologically hate to lose, as do I. Loss aversion theory says we feel the pain of a loss twice as much as we enjoy the pleasure of a win. In some survival sense, this natural position is helpful in, say, staying alive. It means we don’t take unnecessary risks. But it also clouds our ability to reach for better available outcomes.

Over the years, I’ve sat at a lot of tables to make deals, some small and some with lots of zeroes involved. Regardless of location or type of trade, most defaulted to a defensive posture. But that posture is not unbreakable. And once broken down, the outcomes are demonstrably better for everyone.

So why are we here? We’re here to build better deals.

A better deal is measurable; it has a positive sum. If you’ve ever heard the phrase “zero sum,” you know where this is headed. Someone can lose (negative result) and someone can win (positive result), summing to a net outcome of zero. Surely we are capable of better.

But capability and commitment are different things. To actually improve the results requires more work, individually and collectively. What is that work? And, are we willing to do it?

I know what you’re thinking: trust is the obvious missing piece. Trust undoubtedly matters. A better deal won’t be achieved without it. But trust is hard, especially with strangers.

I’m not going to tell you to blindly trust strangers, whether it’s Permanent Equity or another party. Trust, especially in professional settings and with high stakes, is earned. Time, communication, and a demonstrative record of words reconciling with action are required. The only way I know for people to earn real, lasting trust with one another is to spend time together.

So trust isn’t really the answer, not fully. Everyone can be well-intentioned — ethical and moral, communicative and reasonable — and you can still end up with a zero sum outcome. (Disappointing, I agree.)

I’d propose that a zero sum result rarely has much to do with the “other party.” Most deals fail to achieve a positive sum because we screw ourselves. Sometimes before we even sit down at the table. But why?

We don’t understand ourselves as active players. We don’t spend enough time intentionally building our approach. Identifying our unconscious behaviors and beliefs. Brainstorming all the potential upsides. Or assembling options and tools that can help.

We sabotage our own outcome, along with everyone else’s.

So this is an exploration of topics about active participation, causes of less-good deals, and how we can reorient to improve everyone’s outcomes.

Choose a topic and dive in:

On action

On Negotiation

On Outcomes

On action

Participation Trophies

I have played poker exactly three times in my life. With no money stakes involved, I lost all three hands and promptly decided that poker is not a game I play. I could go into more detail about why (e.g., bluffing), but the point is that, given the choice to play poker – be it in Vegas or at a friend’s house – I choose not to play.

You can also choose to not do something. In most deal-inducing situations, you already have something valuable in your possession. You don’t have to do a deal. Choosing not to participate might be less exciting, but you can just keep what you have. No one is forcing you to act.

But no one pats you on the back for doing nothing. So you need to figure out if you’re prone to act. And if you are, you need to be brutally disciplined in evaluating potential deals. People who like deals are people who naturally like action.

The issue is that being celebrated for acting is only a momentary upside. Is a participation trophy actually worth parting with your thing of known value? Definitely not. So your upside – your reason to act – better be something else.

If the upside isn’t clear, channel your action-prone self on something else. Because deals involve trading, and any trade presents tradeoffs and the opportunity to lose.

Good deals make sense. The reward is clear. The risk of potential loss is recognized. There’s a compelling reason to come to the table.

There are circumstances, if less frequent, in which you may find yourself a forced actor. Such lack of optionality should be avoided when possible. The ironic part is that most forced actors get to that position by trading too frequently, thus spreading themselves thin. And then something else goes wrong and they’re out of resources. Another argument for only acting when it makes sense.

But if you do find yourself a forced actor, you still have choices. With rare exception, you can in fact still choose not to act, but at a more significant cost. (And if someone comes to you as a forced actor, you will have to choose whether to be a predator, a partner, or a non-actor.)

In building a deal, you have the following choices:

To come to the table in the first place

To stay or leave

To invite another party

To move quickly or slowly

To set your tone

To explore or commit

To set deadlines

To set units of measure

To accept or decline

To close

To build better deals, you can’t be after participation trophies. Act only when it makes sense to do so, and make conscious choices throughout the process.

On action

Hostage Situation

The conflict in fairy tales often begins with something irresistible – a poisoned apple in Snow White or a sweets-covered house in Hansel & Gretel. And then, inevitably, things go wrong and people end up magically trapped.

Outside fantasyland, to put it bluntly, enticement looks like flirting and unsolicited offers, the trapping looks like contractual terms and implemented changes, and the villains look like any other party.

Here’s one example of how it could work. Let’s say I want to buy your company. I reach out to you, I tell you how wonderful and impressive your company is, and then I tell you a big, round beautiful number that we’re willing to pay for it. The number is so gorgeous that you can’t resist the pull of the deal table.

In all likelihood, I didn’t really confirm much about your company before providing that pretty offer. But it got you to the table. Once at the table, I have tools I can use to keep you there.

One tool is an exclusivity clause in a Letter of Intent, which says you agree not to talk to another suitor while we build a deal. During that time, our team can scrutinize every detail of the business, requiring you to produce all kinds of documentation and pay legal and accounting fees, and then say that I have to reduce our offer by 30% because of a handful of things discovered in diligence.* *(Please note that this is purely illustrative and Permanent Equity has no intentions of behaving this way.)

This is called retrading, it’s a crappy practice, and I probably sound like a villain-in-the-making. Will you leave the table? Well, if I’m attempting to retrade, what I’m counting on to keep you there is a combination of sunk cost and commitment biases, along with any validity to what was discovered.

Before you critique retrading, reflect on your own actions. You let someone who had done very little work to actually get to know your company persuade you to the table, and then you signed a commitment to work with them. You knew the offer was too good to be true, but couldn’t resist.

The good news is that becoming a hostage is entirely avoidable in the real world: When you sit down at the table, you should be reasonably confident that the deal is viable for everyone involved. And you should know what you’re signing up for.

Flirting and commitment are different things. People have all sorts of reasons for serving up compliments. Some are genuine. But when accompanied by an unsolicited, undocumented offer, don’t be enchanted.

When you feel the deal is moving too quickly and seems too good to be true, it’s your choice whether to commit. If you decide to pursue the offer, know that you are potentially embarking on an elaborate exercise with no productive outcome.

An offer made before exchanging information is meaningless. And if you are on the receiving end, you will know better than anyone whether you’ve shared the appropriate level of detail to inform a credible offer.

As the one making the offer, though, I do have to admit that there’s only a certain amount of work I want to do (my “sunk cost”) before I want some assurance that we are both committed to working towards a deal. This means that I will take all the information you provide, but that some detailed analysis or third party work may not be performed until after some sort of commitment is made.

On rare occasions, a retrade will make sense to both sides. Something may be discovered that is new to all parties. Or something that was behaving one way will meaningfully change in the process and have to be reassessed. But it should not be common, it should not make you feel trapped, and it shouldn’t make me a villain. It should be glaringly clear why things need to move (up or down).

Getting trapped doesn’t mean you are forced to do a deal (most modern fairy tales have happy endings). But it may be a headache, and it may take a while to unwind, especially if you have already started to implement changes based on the contemplated deal.

So the best approach is to avoid getting trapped in the first place. And dodging the trap means having reasonable expectations, sharing information, paying attention to details, and not being persuaded by stuff that seems to be too good to be true.

While a well-contemplated offer may not be as tempting initially, it is more likely to be real.

On action

Support, Coaches

& Specialists

When you tell someone you are thinking about doing a deal, at least half the time, you can expect some variation of the following response: “I know a guy who can help…”

Depending on the complexity of negotiations and legal formalities involved, you may, indeed, need people to help you. Great deals often require teamwork.

Don’t confuse support with delegation. Delegated deals are dangerous. If it’s your asset and you’re in the position to agree to or decline the deal, you should be the decision driver 99% of the time. Too often, deal-making gets delegated to helpers. To do so is to outsource your judgment… something I doubt you rarely do in other situations.

Here’s how to think about helpers on a deal:

Deal Driver: Every deal has to have a lead decision maker. This is the person who drives the deal and ultimately commits. In most cases, ownership and accountability determine this role.

Deal Support: Depending on the deal’s complexity, you may benefit from execution support to collect documents, prepare responses, and fulfill other information-oriented tasks. Someone has to do the work, and you need to decide who that should be. Decision makers sometimes try to also do all the work and get dragged down into the weeds, losing sight of big negotiation milestones.

Deal Coach: Depending on who you intend to do a deal with, you may benefit from having a coach. A coach sets you up, gives you feedback, outlines ways you can approach situations, and then sends you out on the field, so to speak. They can’t do the work or make the decision for you, but you value their counsel. Their role is to help you be your best.

Deal Specialist: If you don’t understand something, it’s okay to call in the experts. These could be lawyers or accountants or actual scientists, but the point is that you’re calling on them to review, interpret, and draft stuff that can sometimes look like a foreign language. Their contributions can be meaningful to your deal’s development, but ultimately they are providing elements, not the deal itself. And, for them to be most effective, they’ll need guidance on your priorities, the risks, and what you care about.

The point of helpers is to help. The best helpers recognize this by delivering information and updates in ways that distinguish between options on the table, options not on the table (and why), their personal recommendations, any inconsistencies or red flags, and any missing material information to be considered.

The lead decision maker, though, has to assimilate all the pieces and know the primary goals. Because things can go off track quickly when the coach or specialist becomes the deal driver. It’s not their fault. They are trying to help. But that help comes from a specific point of view.

And because that view is not necessarily fully reflective of the owner’s view, there’s a greater chance of remorse after the deal. Or confusion before you even get there.

On action

Fear of

Missing Out

Too many people discount being at peace after the deal in favor of a narrow focus on the immediate payoff.

Consider this: How would you feel if you sold your house, and two years later its property value doubled? How would you feel if something you sold was restructured? How would you feel if what you sold was later broken up and sold for parts?

If the answer is that you would have some combination of envy, remorse, bewilderment, or just plain anger, for your own sake, you need to spend some time considering what scenarios are most likely to avoid that outcome.

Once you trade, future changes are all but inevitable (and if you’re honest, continued ownership would have you making your own). Conditions change, and the natural response is more change. If when change occurs, your response is regret, you may find your disposition poisoned on both the past and the present with little recourse.

Remember, the future cannot be guaranteed and, individually, you can’t go on forever. What you would do is largely irrelevant if you are no longer the owner.

Even knowing that, you want to avoid regret like the plague. It’s expensive and ugly. In deals, there are two principal ways to defend yourself against that feeling of missing out and regret for what might have been. First, you need rational acceptance of reality. Second, you’ve got to build a deal you want to do.

RATIONAL ACCEPTANCE

When you are confident about the future, your alternative – doing nothing – is also compelling. In this position, your motivations for trading relate to your competing priorities or personal willingness to do what will be required for the future. So, when you do a deal, you should recognize what you’re prioritizing.

This means that you should recognize your loss of ownership and accept it (unless you’re partnering, of course). And acceptance means you should be at peace with whatever may happen in the future.

What if the value meaningfully grows in the future? It shouldn’t upset you. The worst post-deal situation is when one party is spiteful over the other’s post-close success. The best is when you celebrate each other’s successes. It’s why, when I sell my house, I can be happy to have two more bedrooms in my new home and cheer when the buyer of my old home sees the value increase. In my line of work, it can mean celebrating one party’s commercial success and someone else’s grandkid-filled retirement.

If you are only willing to part with something if you expect it to do worse in the future, you should expect a low trade value… if any suitors show up. Wanting something to fail past your ownership inevitably sets up poor deal dynamics.

Have good reasons for trading, and accept reality when you trade.

CONFIDENT CHOICES

Beyond personal acceptance and well wishes, what can you control? You can’t control future conditions or pressures. You can’t dictate future choices. You can, however, select the party in charge.

Owners have strong opinions about judgment. Good ones also recognize that there’s generally more than one path forward. And that’s a helpful lens for evaluating who to trade with. Finding your decision-making twin may prove impossible. You simply need confidence that the next owner has the ability to make thoughtful choices.

Thoughtfulness will become apparent as you build a deal – as will poor judgment. If you willingly trade with someone who exhibits bad judgment, don’t have high expectations for the future. And recognize that you are choosing to do a deal with them anyway.

Evaluation questions for building confidence in another party include:

What are they most likely to do when XYZ happens? How well can that go? How poorly? How would I handle it differently? How different are our ranges of outcomes?

What are they ill-equipped to handle? What would better equip them to respond capably?

When should they call me? Will they?

Will I be proud to tell people who I did a deal with?

Have they done what they said they were going to do so far?

How much do I care what happens after the deal?

Complex trades tend to take awhile. You have multiple chances to consider questions like these. It doesn’t guarantee a perfect future, but you will gain peace of mind that you did everything you could to trade well.

On Negotiation

Polar Positions

A beautiful part of dealmaking is that, most of the time, we arrive at the table because we have different priorities and value things differently. That’s why we’re willing to trade in the first place. So when you get into details, items I care most about – the stuff where I may want to take a personally preferred stance – are rarely the same stuff you care most about. And it makes compromise work reasonably well as long as we don’t insult each other by initially taking polarizing stances. And yet, people frequently start by taking polarizing stances.

Why does it matter where you start?

There’s an annoying adversarial strategy some default to in dealmaking. Each side starts with their ideal positions, and then they slowly whittle each other down until they finally find agreement. This polar positioning strategy is brutal, inefficient, and offensively expensive.

Starting at your personal ideal is naturally taking a stance in which you have zero consideration for another party. If you don’t want to do a deal, that’s fine. But logically, if you want to do a deal, you do have to consider another party. So idealism sets you up to annoy or insult the other party and spend extra time trying to figure out where you can eventually land because you didn’t take them into account in the first place.

The further one party has to travel to meet another, the greater the possibility of divergences, stops, stalls, and retreats that can keep them from ever meeting. And if one side won’t move at all, boy, could things take a while.

A much more efficient path to progress is to base your position in reality, taking into account all parties involved from the beginning. In other words, shorten the distance. A reality-based positioning strategy doesn’t mean that you can’t take a personally preferred stance on anything, but it does take into account that the most extreme version is probably intolerable. And since most deals involve lots of little decisions on certain positions, if you take preferred stances on some, you should also be willing to accept some of the other party’s preferred positions.

Yes, I’m talking about compromise. Finding middle ground.

Beyond the distance itself, if you want to take hard stances and refuse to move towards the other party, you are introducing a dilemma: If you won’t move at all, who is going to stay at the table to do a deal with you?

To shoot it straight, who is that desperate? Having been on the receiving end of some pretty hard stances, this is where we sometimes end up. If I’m at the table with you, I have the option to walk away, remember? And if you are unwilling to consider ways in which the ultimate outcome is compelling for both of us – where we both win – why should I stay?

The answer is that only desperate or bad actors are likely to stay. And being desperate, by definition, means you have limited options. That does not bode well for the deal’s viability, or what happens after the deal.

If you can acknowledge the distance you face on specific issues with the other party, you’ve already set yourselves up for a more efficient negotiation. On some issues, you may find yourselves starting at the exact same position, which can be a huge relationship builder for both sides (we both see reality the same way, yay!). And once you sort priorities, there’s usually only a handful of issues on which each side is going to have to travel some distance.

And if you have to travel, might as well go towards better weather.

On Negotiation

Alternate Realities

& Adjectives

Do you think $1 million is a significant sum of money?

It’s a serious question. And sure, it depends on the context. But when someone says “$1 million” in any context, do you bat an eye?

It’s a question where there is no objective answer, but where personal priorities, values, and background all contribute to each of us believing there is an answer. For a lot of people, the answer is a resounding yes. And for another (admittedly smaller) group, it’s a rounding error. And then a bunch of people are somewhere in the middle, saying they need more context.

This response stratification illustrates that individual reality is not necessarily collective reality. We can’t assume that someone else at the table sees the world exactly the way we do.

When someone says something is delicious, it’s delicious to their individual palette. Most people readily recognize such a take is subjective and may not reflect our personal experience. It may also indicate a barometer scale difference. “World-class” is usually ascribed to the best you’ve ever experienced (e.g., someone will tell you the “best” vacation spot is in Florida, but the person has only ever vacationed in Florida).

But when it comes to politics and business and many other venues, it’s sometimes harder to distinguish individual opinion from supposedly shared reality. And this is because we are woefully imprecise.

When a politician says “big businesses,” to what businesses is she referring? I genuinely don’t know because it’s rarely defined. Is it a business with over 1,000 employees? 10,000? Or is it judged by revenue? Locations? Contribution to GDP?

While we can and should blame politicians for poor rhetoric, this problem extends well beyond podiums. We are often in such a hurry to make our point that we opt for an adjective – big or small, complex or simple, growing or stable – that infers a comparison without actually providing any associated metrics.

Glossing over specifics may help us move faster, but that’s small comfort if we look up to discover that we’ve ended up in alternate realities.

This conundrum can appear when someone says that they have a “fast-growing, high margin, scalable business” seeking investment. Even if that description is paired with the current year’s revenue and earnings, do we have similar definitions for fast, growth, high, or scalable?

Beyond adjectives, binary phrasing can confuse us, too. Risk is often referenced as either present or absent. Except risk is always present, right? Even doing nothing can be risky, so every option on the table absolutely has embedded risks. So, measurement matters. What is your tolerance for risk? Are you up for circumstances swinging 10% in either direction? 50%?

And what types of risks are you willing to face? I’ve had some unexpected responses to that question over the years. It turns out we all have different tolerances, and some of us are more willing to, for example, risk our actual lives, than others.

This is why it’s worthwhile to verify reality, rather than assume it’s shared. We may have the same outline, but color it in differently. And the details on why may enlighten you. Rather than debate the definition of words like “good,” we might as well dig directly into the details.

My approach to this is to pretend I’m blind and uninformed. If you and I are doing a deal, I want you to describe all the details to me directly, as you see them. Why are we at the table? What is the state of affairs? How do things work? What does success look like for each of us? What would failure look like?

Then we can compare your precise answers directly with my own. Ambiguity removed, we know where each of us stands. And if one or both of us need to change planes, we can navigate accordingly.

On Negotiation

Quality Qualms

Doing a deal boils down to this question: Do I want to part with what I have in favor of what you have? Your answer to that question depends on the quality assessment.

First, let’s agree (based on Alternate Realities & Adjectives) that it’s not super constructive to attempt to narrowly define words like “good” or “bad.” We want to do deals, not rewrite the dictionary.

So how do you evaluate and communicate quality?

QUALITY STATE

Discussions on quality usually reference state: past, current, and future. And the categorical information will be of different value to different parties on different assets.

Past: You need a big checkbook to buy a Picasso or a Frank Lloyd Wright house. Provenance, or the origin story and historical ownership of something, can meaningfully contribute to value. But generally, if that’s the source of quality, utility is not a strong consideration.

If something is being considered for utility purposes, the past provides evidence. How did something previously perform? Was it reliable? What happened in various conditions?

The problem with the past is that it means something has been used, potentially a lot. And since most things naturally degrade over time, past performance can also indicate that some of the quality has been used up, or was dependent on conditions during a past period.

Current: Quality based on current state implies that something will be as useful in my hands as it is in yours. New goods, depending on their complexity, usually fall into this category (exceptions are things like art supplies, where expertise outweighs quality in ultimately determining value).

Current state gets tricky when it cannot be maintained post-deal. If something moves or the state of the world changes, will it change the quality? If so, current state may be relevant, but not predictive.

Future: Future state is considered the fun state because this is where people can make stuff up. No one knows exactly how things will play out and every option can now be back on the table.

Future states, of course, cannot be confirmed. And that’s the drawback.

Skepticism invades deals when historic performance and future momentum do not match. Things tend to magically improve in the unknown future.

Why does this matter? To attract suitors, your objective is to communicate the quality of what you have. To most effectively do so, you need to outline what made your asset strong and successful in the past and present, and why its future use cases are compelling, too. And the story needs to make sense, acknowledging any gaps in performance in or between states.

QUALITY MEASUREMENT

Beyond framing quality by state, there are two more helpful lenses to consider: relative measurement and inertia.

Relative Measurement: You can’t assume I know everything, and that includes how your measured results and attributes compare to alternatives.

So, if you are able to charge double the market standard, say so. Or if you grew while the market contracted, show it. Anchor your quality features in comparison to standards or averages.

Inertia: Remember Newton’s first law of motion? Unless acted upon by an external force, something at rest will stay at rest, and something in motion will stay in motion. That logic is also a compelling framework when evaluating the state of complex assets.

Something that has recently grown proves more convincingly that it can grow than something that has stayed steady. However, future state in a deal potentially involves changes in outside forces. And some rates of motion (like very high growth rates in sales) are hard to sustain long term.

Generally, there is a range of momentum that makes sense based on recorded inertia, and it should help inform forecasts (future state). If there is low historic growth or, ironically, one outsized performance period, don’t get carried away.

The core questions are in what direction and at what pace is performance moving?

While quality can be structurally assessed, the ultimate conclusion you or I will draw is subjective and our own. Just because something has been good for you doesn’t mean it will be good for someone other than you. Frame details to persuade others it is.

Go too far, especially in illustrating the future state, though, and risk suspicion. After all, if the future is practically perfect, why are you willing to trade?

On Negotiation

Infinite Interactions

If you zoom out of a specific interaction, an interesting question to evaluate is: Is this a one-time event?

You might recall trying to teach this concept to a child learning to play board games. If you cheat, if you get too aggressive, if you become obnoxious, people will be unlikely to play another game with you.

But if you truly believe it’s a one-time encounter, you may be more inclined to do whatever it takes to win. People commonly treat individual negotiations as one-time events. And a lot of negotiation theory is based on deals being discreet, with the objective being to maximize your personal result in that encounter.

But in real life, how often are isolated events practically true? The concept from advanced math and science courses – if and only if (iff) – relies on everything holding constant, which never happens in the real world.

In the case of selling a business, there are actually 4-500 individual negotiations that make up a deal. And many of those points build upon each other, requiring some level of order in how they are negotiated.

Such a case presents interesting incentives for both parties. There’s an end point (closing). But in order to get there, both sides have to be willing to keep going through each step. The deals-within-a-deal encourage cooperation, at least up to a point.

But in the end, why would one party still not try to “win” over the other, making last-minute changes and demands? If the negotiations are coming to a close, there’s arguably a selfish reason to do so.

The answer is that the deal really doesn’t end at closing, practically, relationally, or, in many cases, operationally. There are shared relationships. There are public reputations to uphold. There are representations and warranties. There is the potential for future support needs from the other party. And, in general, any exchange is more at risk if it’s adversarial.

Sometimes you can get away with treating others poorly, flexing a positional advantage with a server at a restaurant or in negotiations worth millions. Sometimes there’s not a camera or a ready consequence. But these days it’s rare. And if you don’t prioritize shared upside, personal integrity, and trustworthiness anyway, a short-term win is likely to limit your long-term potential.

On Outcomes

Hierarchy of

Deal Outcomes

Abraham Maslow said humans can’t consider much else if we are under physical threat and don’t have a safe place to sleep. Fair enough, and similar logic applies to dealmaking.

A great deal can only be built by parties who can think beyond protecting themselves from immediate danger. If one or both sides feel like they are backed into a corner, they will focus only on personal survival.

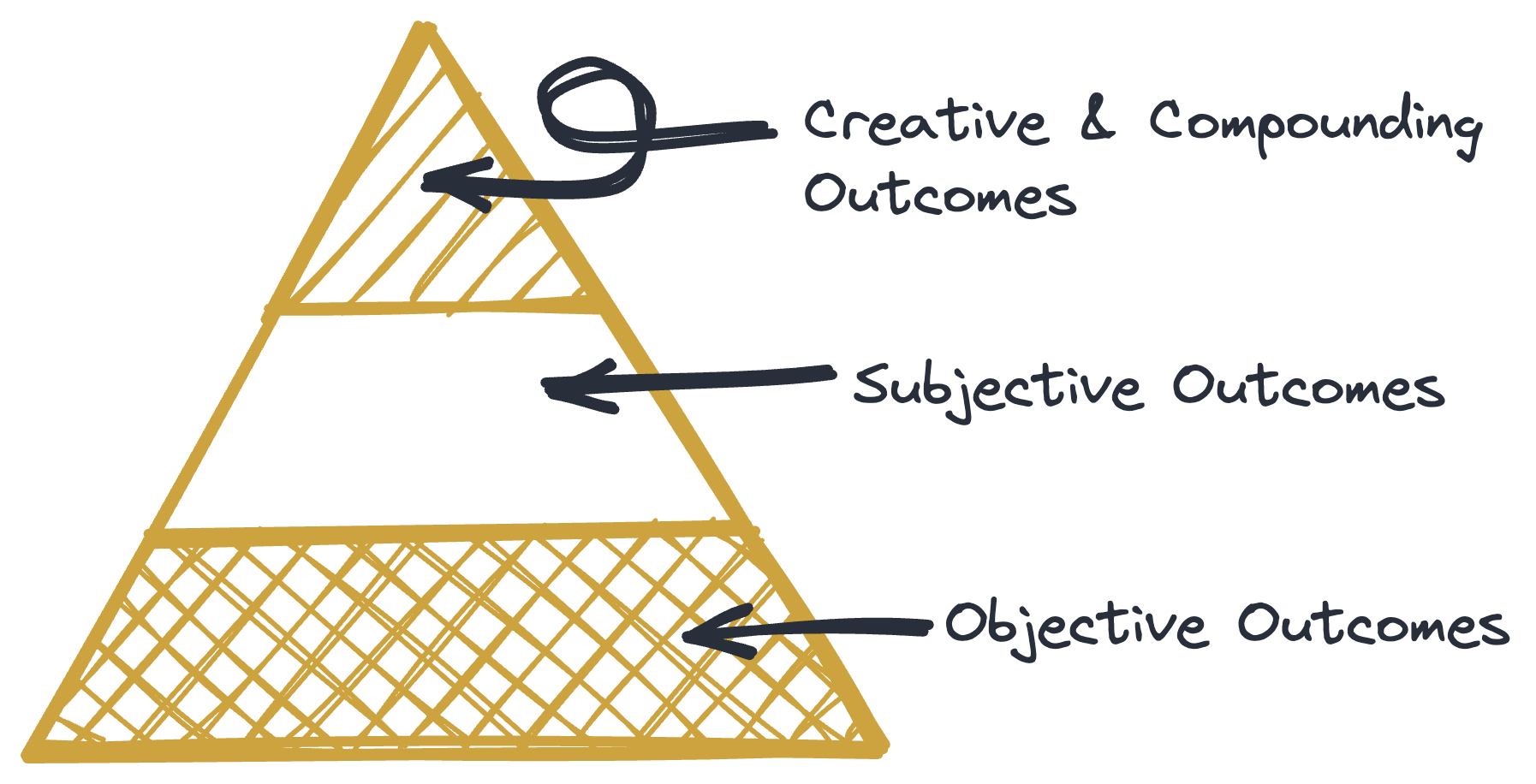

To use the pyramid format, a rough hierarchy of deal outcomes looks like this:

OBJECTIVE OUTCOMES

Objective outcomes are largely calculable. If the trade is worth $10 million to you, you should walk away with A. $10 million, B. a timeline in which you will receive $10 million or more (depending on the length of time and/or payment type), or C. something worth $10 million or more to you.

A deal is hard to jumpstart without an objective outcome outlined for both parties. Satisfaction of the objective outcome determines whether you or I will engage in negotiations in the first place. After all, a deal has to be worth our while.

And if one side believes the other is disingenuous in their offer or representation, you are setting yourself up for a zero-sum deal (someone loses), or no deal at all.

That’s the baseline. But to build a better deal, you want to move beyond objective outcomes as quickly as possible. The deal should be fair to both parties, but the ways in which the deal can become exponentially more valuable to all involved depend on moving past object trading.

SUBJECTIVE OUTCOMES

Subjective outcomes largely relate to how the rippling impact of a deal is handled. In the case of the sale of a company, how are employees and customers affected? How is such a deal announced? What cultural tenants will be upheld?

In negotiating, answers to these types of questions can range from a non-factor to detailed, intentional plans and terms. It depends entirely on what the parties’ priorities are and what will deliver non-objective value (e.g., peace of mind). By prioritizing certain subjective outcomes, you may limit your objective options (e.g., you want to make sure your employees are retained, so you limit potential acquirers to those who intend to operate the business independently going forward), but you are knowingly doing so in favor of something you consider more holistically worthwhile.

CREATIVE & COMPOUNDING OUTCOMES

The best deals will achieve results otherwise unattainable. They may unlock new sources of value, or positively change trajectory. Or they may address issues with no concrete answers.

A valid reason for entering into deal talks is to take on more resources in order to achieve greater goals. But sometimes exactly how the resources come together, or which ones will prove most important, is not clear upfront. Nor is the ultimate goal. This type of arrangement is the foundation of any good partnership: you’re coming together to build something better, but expect there to be some messiness in the early days to arrange, test, and rearrange, and go through that cycle again (and again).

Oftentimes, deals that are able to knowingly achieve this level of success by close are doing so because both sides are bringing up thoughts about what happens later. It requires vulnerability (like “this is something we want to improve”) and a helpful posture (questions and suggestions, rather than criticism and judgment). When it works well, you’ve built something better than whatever was initially exchanged, and you can be satisfied with the choices made along the way.

On Outcomes

Upside & Downside

Knowns & Unknowns

A non-intuitive reality of Permanent Equity’s negotiations is that, for most sellers, if measured purely by the financial ledger, maintaining ownership in a company will provide a better personal outcome than selling it (not acting). Where you used to know directly how you were reinvesting and growing your equity value, you now have to rely on other assets and other managers to grow value (if you allocate at all). You restrict the number of years in which you benefit from the company’s prosperity. And, when you sell, you have to pay not-insignificant taxes on gain.

So why do owners still sell? Endless reasons. Oftentimes, the vast majority of their net worth is illiquid in the business, so when we exchange cash for ownership interest, that liquidity is valuable. Sometimes the business needs more or different resources to achieve growth or stay competitive. And some owners don’t want to continue waking up each and every day thinking about operations or stomaching the risks for both the company and their families.

Certainty may sound like a strange way to measure an outcome, but over the years, I’ve found it to resonate far and wide. In monetary exchanges specifically, cash offers the ultimate certainty, while it is not representative of the ultimate upside. And therein lies a breakdown of the different units of value for each party.

Permanent Equity works to earn a return for our investors by investing in companies on a multiple of earnings (usually equivalent to a certain number of years of recent earnings), and then supporting those companies to sustainably grow, compounding earnings over the years to come. In short, we get paid to take certain risks on behalf of investors that may provide more upside than the cash they already have.

But that upside is not guaranteed. In fact, whether it's a worldwide pandemic or a factory fire, there are a lot of reasons why a company may not survive, let alone grow. Some can be predicted, while others come out of nowhere. So our team needs to make responsible decisions on what we invest in, how we support and resource, and how we manage our investors’ money generally.

Therefore, when we enter into negotiations, we spend a fair bit of time talking through priorities around certainty and risk. Does the seller want to benefit from the potential upside of the future, or have complete certainty? What risks are identifiable, and who is willing to hold them under what terms? How do we collectively handle the unknowable?

The intent in explaining this difference is to illustrate that there are multiple units of value to count in measuring an outcome. Many are tied to certainty and accountability, especially when it involves something that requires active management.

So as you assess what you’re looking for in a deal, it’s worth plotting how you value certainty, how you think about accountability, and what you’re willing to risk for potential upside (fear of missing out). There’s a reason people hold on to assets in vaults and deposit boxes for decades. But some things can’t – or shouldn’t – be managed that way.

On Outcomes

Ask All the

Questions

Assumptions, like ambiguity, cause all sorts of issues. And in complex deals, accurate assumptions can be verified quickly. So why not ask the question in the first place?

People will argue that deals rely on momentum, so if you dig too far into the weeds, it may throw things off. Rarely does downshifting a gear to confirm details take the group off track. What’s more likely to derail everything is proceeding under bad assumptions.

Better deals require caring about details and working through them. It doesn’t mean you’ll love every response (if you do, it might be time to run a trust check and a too-good-to-be-true check). Some things require debate or puzzle solving. And every choice has tradeoffs. When you can name the hard stuff, you gain clarity on priorities, know where to spend time, and can ultimately build confidence in your decisions.

People sometimes limit their inquiries to avoid appearing ignorant or difficult. This is exactly the kind of self-sabotage that leads to poor outcomes. Especially when you feel out of your depth or like the discussion switched languages, ask for a translation. If it makes you feel better, phrase it as a hypothetical: “How would you explain that to a 10-year-old?” If you can’t get a clear answer, it should probably prompt other lines of questioning (like “why does this need to be so complicated?”).

Questions are a cornerstone of real relationships (along with listening). Interest in the other party is healthy, not intrusive. Dialogue develops mutual understanding. Which can lead to trust. Which, ultimately, results in better deals.