Charting the Economic Recovery

This essay by Dr. Aaron Hedlund, Associate Professor of Economics at the University of Missouri, is the first in a series of collaborations we’re calling Outside Insights.

Summary Economic Insights

The economic recovery is ahead of schedule but losing steam as of late, particularly with the rise in permanent job losses.

Viewed as a whole, households are sitting on a mountain of savings and pent-up demand ready to be unleashed as vaccinations accelerate. However, underneath the surface is a wide disparity in fortunes between high-wage and low-wage workers that may impact consumption patterns.

The pandemic has most severely affected the smallest of small businesses and those operating in high-contact industries, especially the leisure and hospitality sector.

As the economy continues to reopen, long extensions and greater generosity of unemployment benefits will shift from being a tailwind for consumer spending to a headwind slowing the return to full employment. The Employee Retention Tax Credit can offer a lifeline to small businesses.

The economy is likely to partly revert to its pre-pandemic state, but some degree of permanent reallocation is also to be expected. A continued partial shift to remote work, a shift in consumer preferences toward the home, and a changing balance of power between small “mom and pop” shops and larger “superstar” firms is likely to take place.

Action Items for Small-to-Midsize Businesses

Businesses should adjust their inventory, supply chain, and workforce planning in anticipation of an impending consumer spending surge fueled by pent-up demand, record accumulated savings, fiscal stimulus, and continued vaccinations. In the short term, food, clothing, utilities, household supplies, and personal care are likely to surge the most. Travel may follow as the virus recedes.

Businesses—particularly those in high-contact, low-wage industries—should anticipate potential hiring difficulties that may coincide with the consumer demand surge, especially with generous unemployment benefits likely to continue through summer and near record low job leaving rates.

Businesses should evaluate their capital investment and debt management plans in light of likely modest-to-moderate increases in inflation and longer-term interest rates.

Businesses should heed the evolution in consumer preferences (e.g. prioritization of household amenities, propensity to shop online) and worker expectations (e.g. scheduling flexibility, sick leave, remote work, etc.) that are likely to endure at least in part beyond the pandemic.

Even the Oxford Dictionary could not escape the abyss of 2020, finding itself unable to settle on a single choice for word of the year. Instead, it went with several “Words of an Unprecedented Year,” such as lockdown, circuit-breaker, and furlough. Perhaps “unprecedented” would have sufficed for the sake of brevity. Regardless, with 2020 in the rearview mirror, attention now shifts to assessing the state of the economy at present and its outlook for the rest of 2021 and beyond. Amidst the green shoots of recovery are numerous potential hurdles and opportunities with a hefty dose of uncertainty to boot, especially in light of the vast divergence in fortunes across sectors, business sizes, and occupations that manifested during the pandemic and which persists today. Here we distill some of the most illuminating economic data and provide insights on some of its potential implications for businesses.

A Birds-Eye View of the Recovery to Date

According to the metric of gross domestic product, the COVID-induced recession has been the wildest rollercoaster in modern U.S. economic history. In the second quarter of 2020, real (inflation-adjusted) GDP posted a record 31.4% annualized decline (the statistic reported by the Federal government, which states by how much the economy would have shrunk had the contraction maintained that pace for a full year). The economy has regained ground faster than any forecasters were predicting back in the spring or summer of 2020 but still entered 2021 producing below its pre-pandemic level of output.

Income, Consumption, and Saving

Despite the enormous hit to GDP, this recession stands out from past downturns in that total household income actually went up in 2020 despite the dramatic rise in the unemployment rate to double digits leading to a large drop in wages. How is this possible? The answer resides with the $2+ trillion CARES Act and other fiscal relief that delivered enhanced unemployment benefits and Economic Impact Payments (i.e. “stimulus checks”) to more than replace lost income. The pandemic disruptions also precipitated a historic decline in consumer spending. Together, the rise in income and drop in consumption fueled the highest recorded personal saving rate with consumers sitting on an additional $1+ trillion in savings.

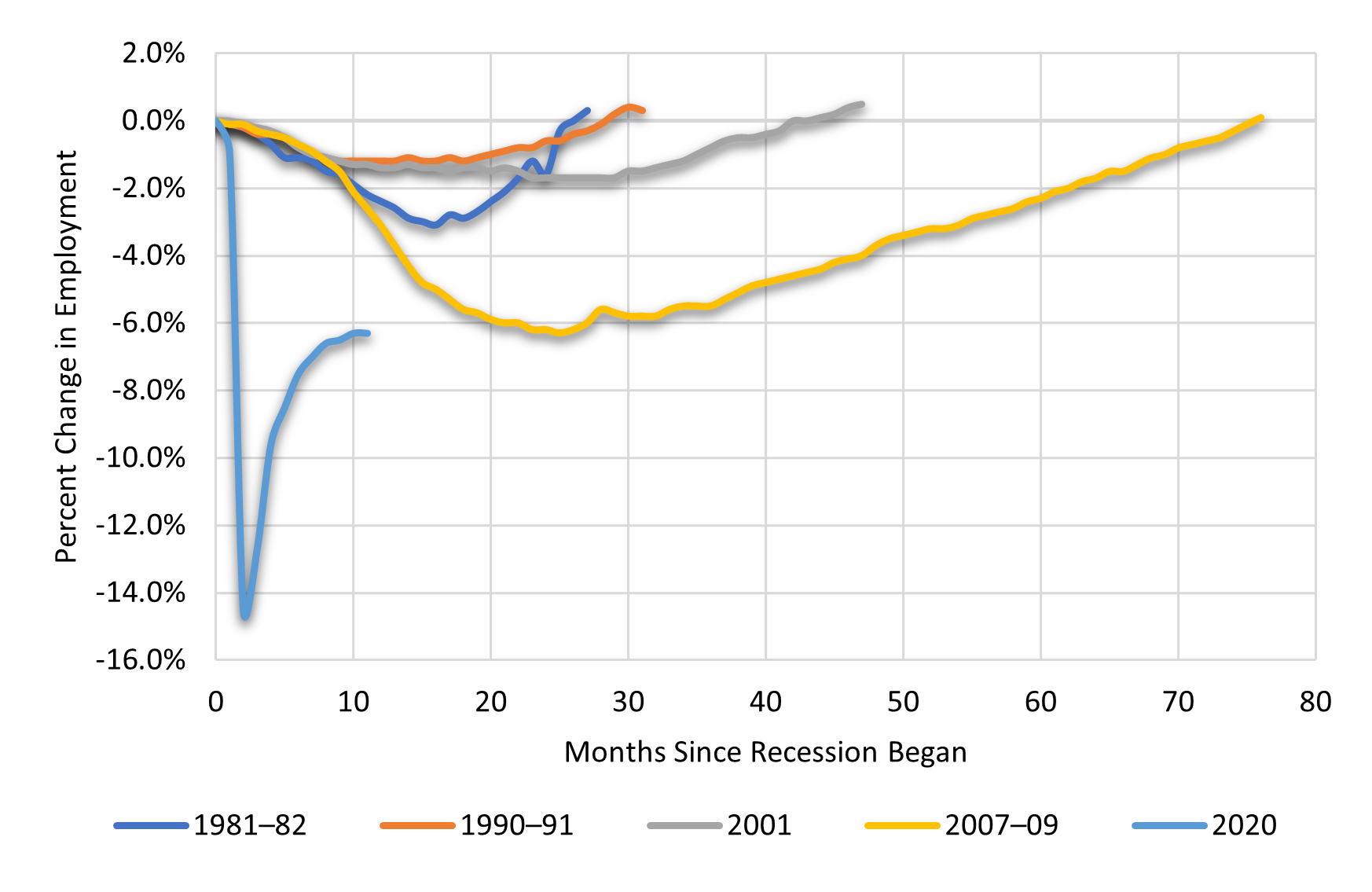

Figure 1: Employment Dynamics Across Recessions. Source: Bureau of Labor Statistics (BLS)

Jobs and Unemployment

On the labor market front, the U.S. economy shed jobs at a rate never before seen during the second quarter of 2020, but the recovery to date has also proven more robust than after any previous recession and stands in stark contrast to the lackluster recovery following the 2007-09 Great Recession, as shown in Figure 1. However, the last three months have shown concerning signs of a slowdown, with the 6.3% January 2021 unemployment rate sitting only 0.6 percentage points lower than it was in October. Also, new and continuing unemployment insurance (UI) claims—which had been on a steep descent through much of the summer and fall—have nearly stalled out recently, as shown in Figure 2. For context, new UI claims represent the flow of laid off workers into unemployment, whereas continuing claims measure the stock of unemployed workers and is generally viewed as a more reliable barometer because in a high-churn economy, there could be high flows both into and out of unemployment. That said, gauging the level of continuing unemployment claims has raised a new set of thorny issues during the pandemic because of overcounting issues related to the introduction of Pandemic Unemployment Assistance for gig workers and others who in the past would not have qualified for unemployment benefits.

Broader Labor Market Indicators

Other indicators that provide a more comprehensive gauge of the labor market recovery include the U-6 unemployment rate, the labor force participation rate, and the employment-to-population ratio. Unlike the traditional U-3 unemployment rate reported in the headlines each month, the U-6 rate accounts for underemployed and marginally attached workers, acting as a stronger signal of labor market tightness. The U-6 unemployment rate currently sits at 11.1%, which is far above the 6.9% January 2020 rate but less than half its peak of 22.9% in April 2020. For perspective, more than five years passed between the time that the U-6 rate peaked at 17.2% in the Great Recession and when it fell below 11% in 2015. More alarmingly, the labor force participation rate and the employment-to-population ratio are lower than at any point over the past twenty years. What is the common thread? The U.S. economy is still operating well below capacity, and uncertainty surrounding the pace of the recovery has significant implications for everything from short-and-medium-run inflation to long-term scarring.

Figure 2: New and Continuing Unemployment Insurance Claims. Source: BLS

Looking Under the Hood

The trajectories of total GDP and employment belie a more complex story regarding how the pandemic recession has impacted businesses and households of different stripes. For businesses, the recovery has varied tremendously across sectors, with financial activities and utilities at one end of the spectrum maintaining relatively stable employment throughout the pandemic, other sectors such as professional and business services experiencing larger downturns coupled with fairly robust rebounds, and still other sectors that remain substantially depressed. Most notably, the leisure and hospitality sector still faces a 4 million job shortfall compared to twelve months ago. While employment gains have been fairly steady across most sectors during the summer and fall, the fortunes of the leisure and hospitality industry have been more uneven. Since November 2020, the sector has shed 600,000 jobs in the face of a resurgent virus that has led to a selective reimposition of government restrictions in some locales and contributed to heightened precautionary behavior among people reluctant to travel.

Small Businesses

A newly released Federal Reserve survey of small businesses highlights other dimensions along which the pandemic recession has had asymmetric effects [link]. Back when the survey was conducted in September and October 2020, 57% of firms reported their financial condition as being fair or poor, but 80% of firms in leisure and hospitality answered in this way compared to only 50% of manufacturing firms. Moreover, firms expressed different challenges, with some showing the most concern about government mandates and others listing weak demand as the most daunting headwind. Worries about worker availability and supply chain disruptions also varied widely by industry and also to some extent by size of business, with firms in the 50 – 499 employee range more likely to register worker availability issues. By contrast, when it comes to sales expectations, the smallest businesses—those in the 1 to 4 employee range—signaled the most pessimism, with 39% of said firms anticipating revenue losses in excess of 50% versus just 16% of larger small businesses indicating such dramatic expectations of decline. A recent study relates these performance differences to the link between firm size and factors—namely, revenue resilience, labor flexibility, and exposure to committed costs—that impact small business survival after an adverse shock. Moreover, it is not just the small firms, but also the new and perceived-to-be-risky firms that have lost out during COVID-19, with research finding a reduced talent flow to startups as workers seek greater economic security. The flight to safety that was most severe in the early stages of the pandemic has also created some liquidity and credit access issues for small businesses, private equity, and venture capital.

Households

Household economic fortunes have also followed divergent trajectories depending on a range of factors. Workers employed in high-contact occupations faced greater job losses last spring and still face greater job shortfalls, particularly with the retrenchment in leisure and hospitality jobs in the past few months. These patterns help explain why low-wage employment is around 20% below pre-pandemic levels and stalled out, whereas high-wage workers—who experienced a milder initial drop—have fully recovered. These facts also provide needed texture to the previous description of accumulated household savings. Data from JP Morgan show that, although the average checking account is flush compare to before the pandemic from the fiscal relief, low-income households have nearly drawn down their surge in balances.

Prospects for 2021 and Beyond

What does all of this mean for the economy going forward? The labor market recovery is still ahead of schedule relative to early projections, and the accelerating rate of vaccinations— now at almost 2 million a day —offers hope that COVID-19’s effects will dissipate sometime around mid-year. In the meantime, however, the recovery has been losing steam—especially for people unable to work remotely and those facing childcare constraints. Plus, job losses are shifting from temporary layoffs to permanent job losses, with the share of temporary job losses falling from 78% of the unemployed to 27% while the number of permanent job losers has increased by 1.5 million since April. In addition, the fraction of unemployed workers who have been jobless for 27 weeks or longer is near troubling Great Recession levels, as shown by Figure 3. If the slowdown persists, long-term unemployment could form damaging economic scars as workers lose their attachment to the labor market, resulting in permanent earnings losses and making them vulnerable to financial distress as their balance sheets deteriorate.

Figure 3: Percent of Unemployed Who Have Been Jobless for 27+ Weeks. Source: BLS.

The Labor Market

The pace of the labor market recovery also has implications for inflation expectations. If job growth is anemic, the Federal Reserve will face considerable pressure to stand pat and leave rates at historic lows. At the same time, after nearly a year of lockdowns and restrictions, and now sitting on historic levels of liquid savings, consumers are likely ready to unleash a wave of pent-up demand, especially if the Federal government passes another fiscal package with generous unemployment benefits and direct payments.

Implication for Businesses: prepare for a coming surge in consumer demand, particularly in food, clothing, utilities, household supplies, and personal care followed eventually by travel and other experiential goods and services that have been suppressed during the pandemic.

The faster that job growth returns, the better the supply-side of the economy can accommodate a surge in demand without inflation. As things stand, inflation expectations for the next five years have already risen from a low of 0.14% last March to over 2.3% this February. Naturally, job growth itself depends on consumer demand, but the conventional fiscal policy narrative is often oversimplified. The decision to hire is based not just on immediate circumstances such as a fleeting surge in demand but also on future expectations as well as, of course, on the ease and cost of obtaining labor.

Implication for Businesses: evaluate capital investment and debt management plans with the expectation that inflation and longer-term interest rates are likely to rise at least modestly in the face of robust deficit spending and highly accommodative monetary policy, especially with the Federal Reserve’s new monetary policy framework that is more tolerant of short-run inflation.

With regard to hiring, there is evidence that extra generous unemployment benefits likely played a helpful role back in the spring and summer by boosting consumer spending without unduly discouraging work. Although some people point to these findings as justification for continuing to extend generous benefits, circumstances change. Back in the summer, the $600 UI supplement had a legislatively defined expiration date, and jobs were extremely scarce. Thus, it would have been a risky proposition for jobless workers to turn down the economic security of a job offer—not knowing when the next one might arrive—just to receive $600 weekly unemployment benefit supplements for a short period of time. Now that the unemployment rate is less than half its peak and the economy is continuing to open up as more people get vaccinated, the logic and evidence shift considerably. In particular, if allowed to go on for too long or if made excessively generous, unemployment benefits run the risk of becoming a headwind for the labor recovery. By contrast, the Employee Retention Tax Credit expansion from the December fiscal relief bill offers a lifeline to small businesses by reducing the cost of labor and offers hope to workers by providing the kind of targeted ammo needed to accelerate the rate of job offers to the unemployed.

Implication for Businesses: anticipate potential hiring difficulties, particularly in high-contact industries among low-wage jobs. Plan for ways to accommodate high demand in the face of worker shortages.

Debt Overhang

To summarize, the current labor market outlook simultaneously presents reasons for hope and concern, but there are other sources of risk too related to the financial positions of some segments of households and businesses. Between March and October 2020, more than $2 trillion of loans entered forbearance and among small businesses, 38% made late payments as a way to address financial challenges. While obviously preferable to the alternative of widespread delinquencies, the economy will eventually have to reckon with the overhang of debt and rent obligations. An orderly sorting out of back payments will require a combination of sound public policy and creative thinking by private lenders and landlords. To the upside, evidence indicates that the forgivable loans from the Paycheck Protection Program replaced other borrowing, thus leaving small businesses with healthier balance sheets than without the program.

The Million Dollar Question: Return to Normal or Permanent Reallocation?

The philosophy behind the Federal government’s interventions of 2020 was one of short-term relief to lay the foundation for medium-run recovery with less attention paid to the uncertain long run. Likewise, for many businesses and households, survival was priority one in 2020. Even so, the eventual end of the public health crisis does not necessarily imply a return to the same pre-pandemic economy. Instead, the prospect of widespread economic reallocation from shifts in consumer spending patterns, geographic reshuffling, occupational shifting, supply chain realignment, and other responses to a landscape with more salient perceptions of pandemic risk offers promise and peril to entrepreneurs, owners, and investors. While the nature and full extent of these changes is impossible to predict, some trends are likely to stay.

Most prominently, the shift to remote work is likely to remain at least in part. The unique circumstances of 2020 compressed the timeline for investment in remote technologies and initiated a rapid shift in workplace norms surrounding the acceptability of working from home. As of spring 2020, around 37% of jobs had the capacity to be performed fully at home. It is entirely plausible that this fraction will increase over time, although with significant variation in feasibility across cities, industries, and income groups.

Implication for Businesses: plan for a world in which consumers adjust their behavior in anticipation that there could be (though hopefully not!) future pandemics that lead to constrained mobility and economic activity. Hiring should also take into account shifts in worker expectations surrounding schedule flexibility, policies for sick leave, and the acceptability of remote work.

Fueled by the flexibility of remote work plus a heightened appreciation for home and outdoor amenities in response to prolonged lockdowns, people have been spending heavily on home improvement or else taking even more dramatic actions to relocate outside the city or in entirely new areas with more space and cheaper housing costs. In short, the changes wrought by COVID have cut the urban living premium.

Lastly, at least in the short run, the disparate impact of the pandemic recession on the smallest of small businesses may accelerate the pre-pandemic trend of “superstar” firms acquiring greater market shares. Recent research has highlighted the role of globalization and technological changes in pushing sales to the most productive firms, thereby driving up market concentration. The effects are most pronounced in services, wholesale trade, and retail trade as national chains and the top firms within each industry expand into more local markets. With the disproportionate exit of small firms during the pandemic, this trend may continue unless entrepreneurs identify ways to more nimbly respond to the shift in tectonic plates that will characterize the economic landscape in the aftermath of COVID.

Parting Thoughts

The economy is poised for a short-run boost to consumer demand and economic growth at the same time that it is vulnerable to considerable medium-term uncertainty regarding the pace of recovery in the labor market and among the smallest of small businesses that will determine the degree of long-run scarring. In the short term, businesses would be well-advised to calibrate their inventory, supply chain, workforce, investment, and debt management policies in light of current economic trends. Going forward, businesses should examine the evolving preferences of their customer bases as well as the shifting expectations of current and prospective employees that are likely to endure at least in part beyond the pandemic. Lastly, uncertainty also presents potential acquisition and partnership opportunities to investors from businesses that have strong long-term value propositions but may suffer from viability vulnerabilities from short-run cash flow shortages and interruptions to their workforce, supply chain relationships, and credit access.

Dr. Aaron Hedlund is a tenured Associate Professor of Economics at the University of Missouri and a Research Fellow at the Federal Reserve Bank of St. Louis. He has previously served as the Chief Domestic Economist and Senior Adviser at the White House Council of Economic Advisers. Dr. Hedlund’s research focuses on the intersection of macroeconomics, finance, real estate, and labor. He received his Ph.D. in economics from the University of Pennsylvania and his Bachelor's in economics and mathematics from Duke University.