Employee Covid-19 Impact Survey

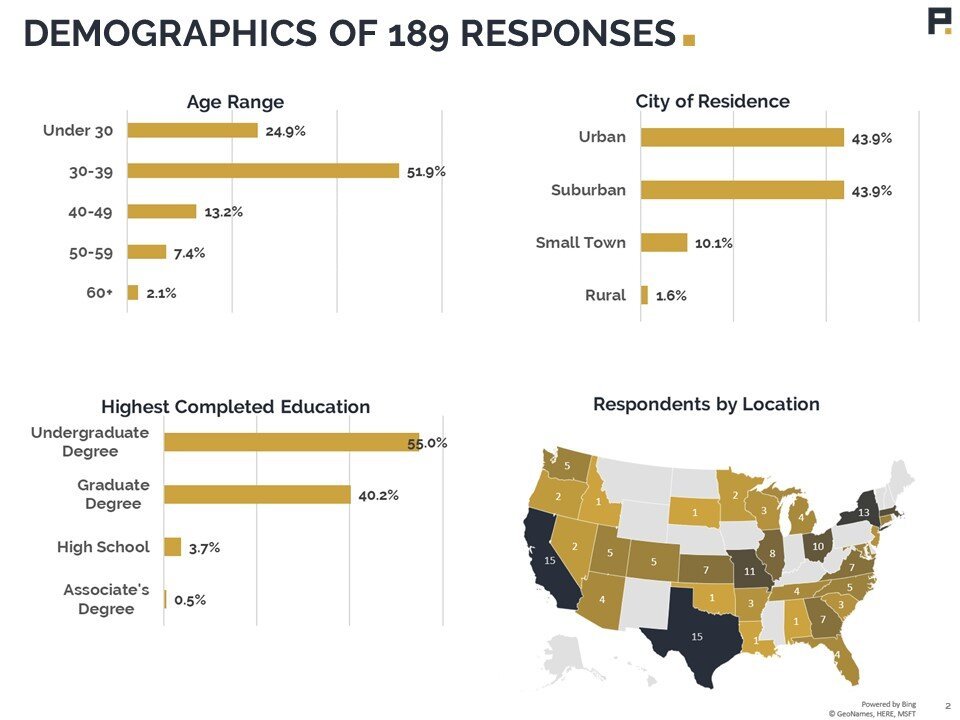

Yesterday morning’s announcement of an additional 3 million+ initial jobless claims pushed the total jobs lost due to COVID-19 over the 30 million mark. Responding to a survey two weeks ago, 189 people, both employed and unemployed, shared with us how their work and personal lives are being impacted by the COVID-19 shutdown.

We saw in our Owner/Operator Survey that an entrepreneurial spirit is driving business owners who have the means to power through this crisis. Employees, however, are feeling more vulnerable, with 85% of respondents saying they know at least one person currently unemployed.

We’ve put together a brief writeup of key findings with the full analysis in a slideshow at the end.

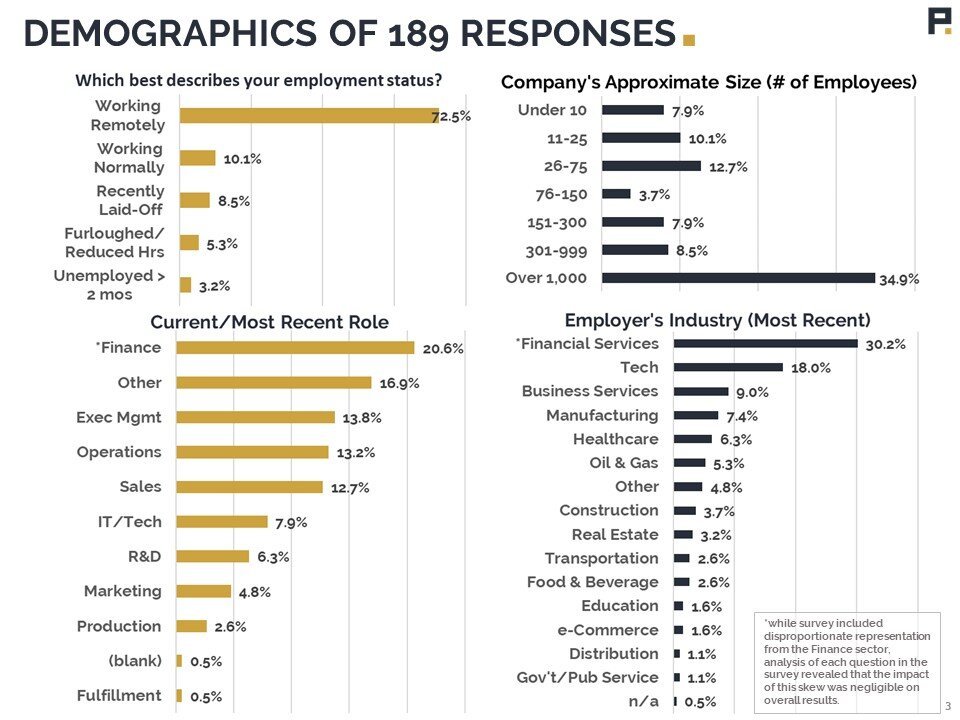

*Note: while our survey included disproportionate representation from the Finance sector, analysis of each question in the survey revealed that the impact of this skew was negligible on results.

Employment Status

The work life impact of COVID-19 cannot be overstated. Only 10% of respondents report that they are working normally during the shutdown. 73% are still working, but must do so remotely (more on this later), and 17% are currently out of work - a combination of layoffs and furloughs.

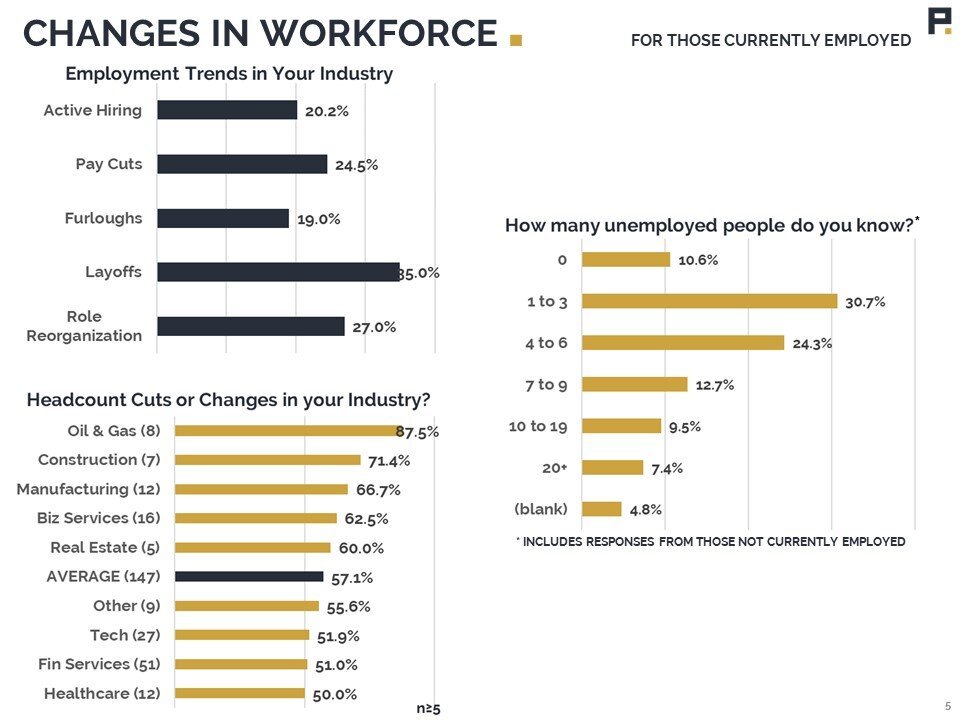

85% of those surveyed know at least one person who is out of work and 57% of are aware of some form of workforce modification going on in their industry. This number varies based on industry, with 88% of Oil and Gas employees being aware of workforce changes, down to 50% of Healthcare workers.

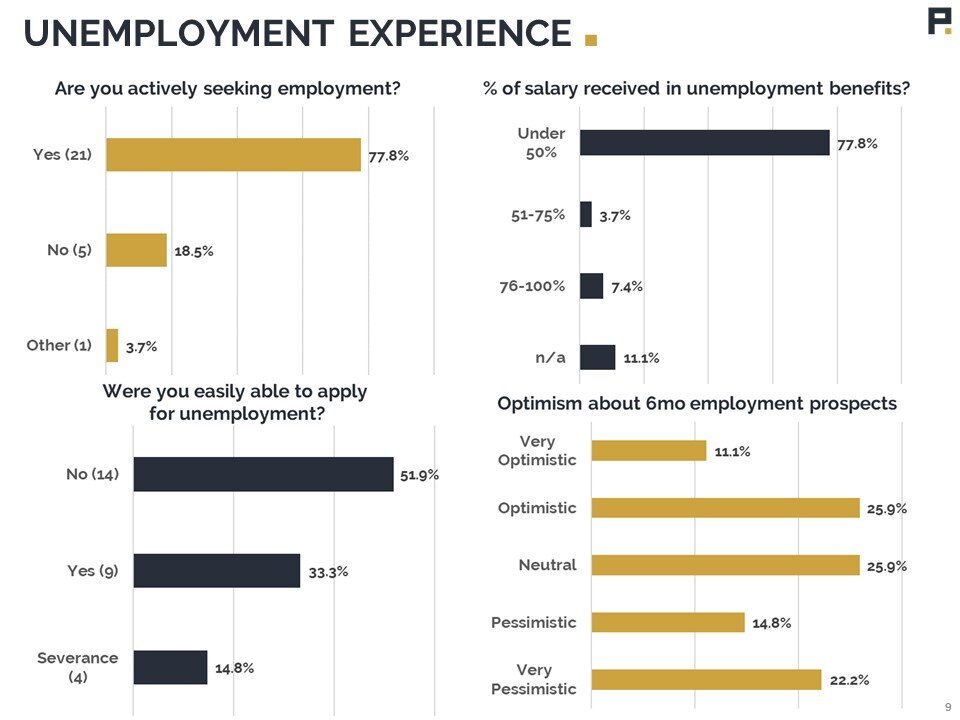

Of respondents who are unemployed, 78% are actively seeking employment. When asked if they were able to easily apply for and obtain unemployment benefits, 52% answered “no,” and that’s with 15% of the surveyed population ineligible to apply because of severance payments. 78% of the unemployed surveyed stated they are receiving less than 50% of their prior compensation from unemployment benefits. Unemployed respondents are evenly split between feeling optimistic and pessimistic about their employment prospects over the next 6 months.

Company Impact

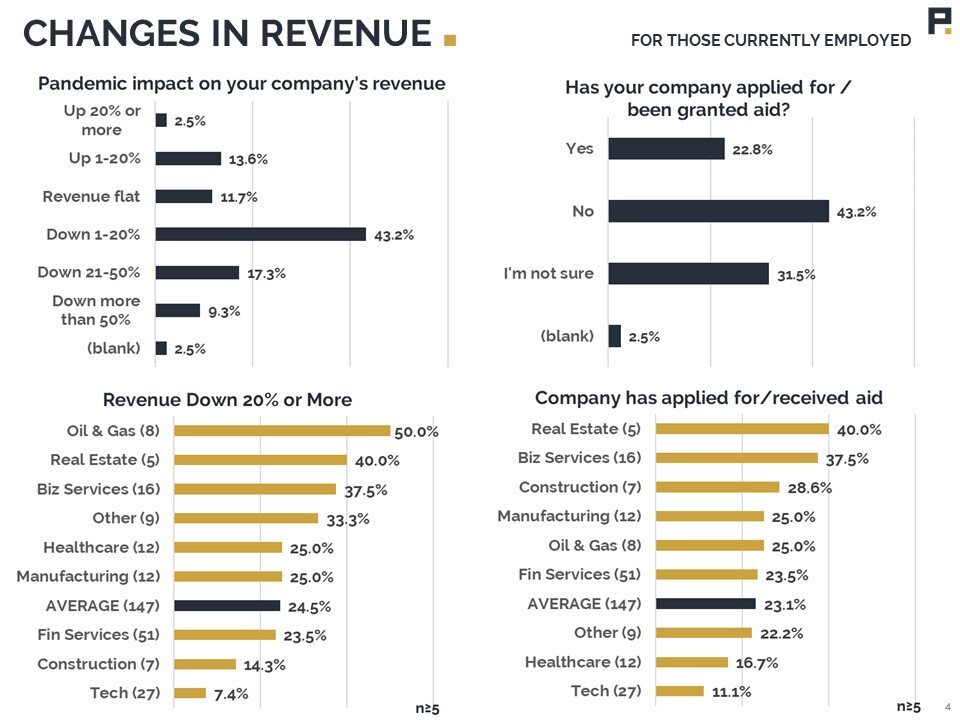

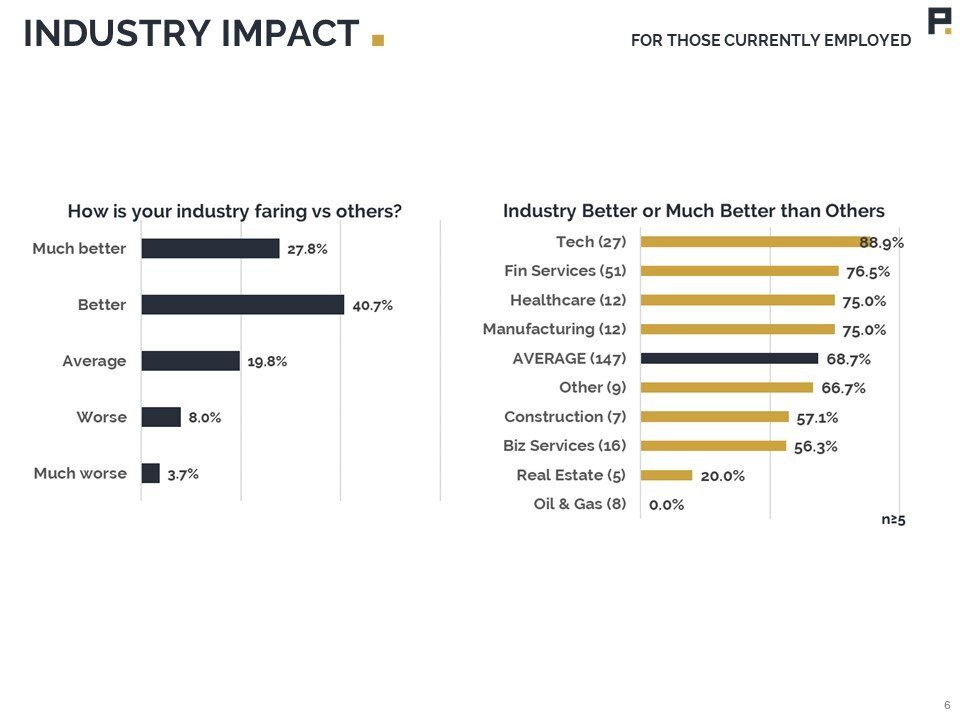

70% of respondents believe their company’s revenues have been negatively affected, and 27% believe revenues to be down by 20% or more. The vast majority of those surveyed believe their industry is faring better than others with more pessimism amongst those working in Real Estate or Oil and Gas.

Working From Home

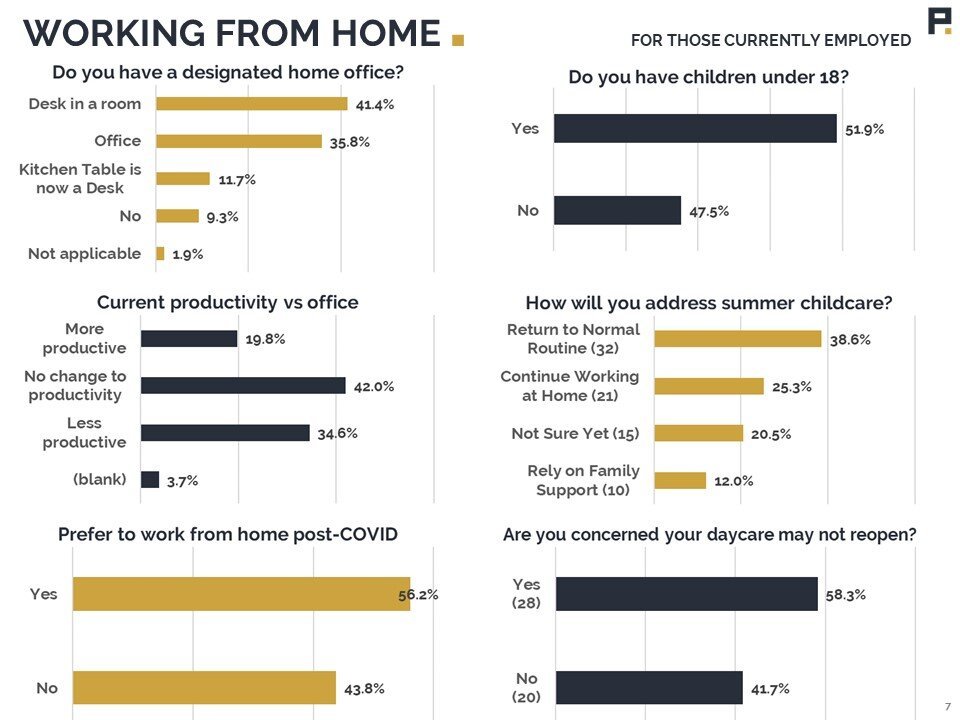

In our Owner/Operator survey, 70% of business owners did not intend to expand work from home options post-crisis. Employees seem to feel differently, with 62% reporting that they have the same or more productivity when working from home and over half stating they would prefer to work from home after restrictions are lifted.

Bigger concerns are raised with childcare. Only 39% of those with children say they can return to a normal schedule post-crisis, with the balance needing to either continue working from home, relying on family, or unsure of how they’re going to handle their childcare needs.

Other Personal Effects

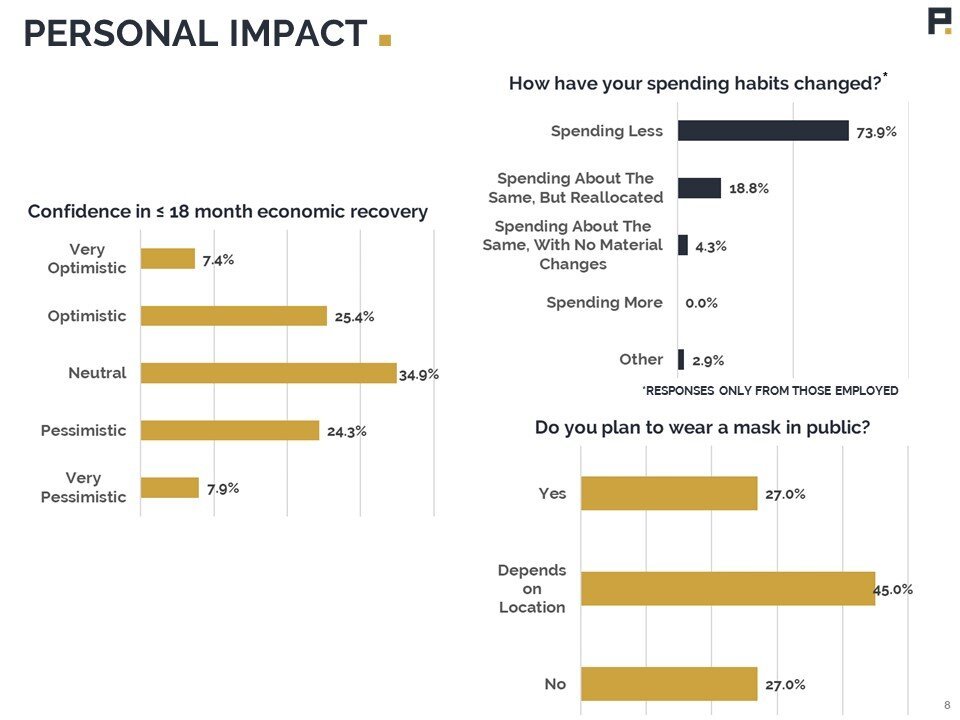

Employee confidence in an economic recovery formed almost a perfect bell curve, with opinions split down the middle. Spending in households that are still employed has changed dramatically, with only 4% of those surveyed saying their spending had not changed since before the crisis.

Conclusion

Even if employees haven’t felt a direct pandemic-driven impact on their own job, they are keenly aware of its effect around them. 91% of those responding either know someone who is unemployed and/or are seeing staffing changes in their industry. For those who have been let go or are furloughed, please feel free to join our Orbit program - one of the many ways we look for talent for our portfolio companies.

For SMB owners and operators, crises like these are where lifetime trust can be earned or burned with your team. We have some suggestions on how to speak to your employees during tough times in this piece on cutting costs. If we can be helpful, please reach out.