Unqualified Opinions 4/3/23 - 4/7/23

By Tim Hanson

Have Fun Writing Memos

(4/3/2023)

When I was a kid I played baseball and my favorite game days were when we got to play a double header. I think that was because it gave me an excuse, if not a reason, to spend the entire day doing something I truly enjoyed.

I think about this whenever I start to draft an investment memo. See, we’ve iterated into a process at Permanent Equity whereby the investing team circulates a full-blown analysis to the diligence and operating teams before we start diligence. The reason is that we want everyone to understand what it is we think we are investing in and then empower anyone to throw a flag if they come across anything that runs counter to that thesis. That can be in the numbers, the people, the opportunities, or the risks.

But the point about fun is that that’s what I want to have as I write the memo. If it’s not fun to write about an investment, it’s not going to be fun to hold it for 27 years. Because if you’re not passionate about the numbers, the people, the opportunities, and the risks, it will be brutal to endure all of the volatility that will happen along the way.

The other week Mark and I went to visit a prospective partner. We spent a couple of hours together and at the end of it he said, “That was fun. You guys should have planned to stay for dinner.”

We replied half-jokingly, “Well, we give people a couple of hours first. And if that goes well, a day or two. And then we jump to 27 years.”

But it’s true that if you’re going to do something for a long time, you have to enjoy doing it. So even though it’s completely a non-financial question, it’s entirely credible to ask before making any kind of investment, “Is this going to be fun?”

Growth, and Other People’s Money

(4/4/23)

I saw the financials recently of a relatively small business that aspires to be a premium global consumer brand. Not only that, but it’s made some progress towards achieving that goal and may ultimately get there. But what was interesting to me was the trajectory of the company’s growth and what that might portend.

Rewind three years and this was a company that was growing ~25% annually with gross margins around 50% – well above the industry average. That’s a real success story: good growth with premium pricing. Those numbers suggest that there was a there there that’s really resonating with consumers.

At that time the company decided to take on outside capital so (1) the founder could take some chips off the table and (2) the company could invest in its balance sheet. That capital came from one of the big well-known firms through a fund that had less than 5 years left on its fund life.

What do you think happened next?

When I think about trying to build a valuable brand, I always think back to the time I met Brunello Cucinelli at an investment conference in Paris. His namesake fashion house was newly public at the time and he was trying to set expectations in the market. He told everyone at that conference that his company would never grow too fast, that he would aspire to gracious growth, and that he would protect quality, reputation, and margins at all costs. That, I suppose, is how you sell $2,495 cargo pants.

What an approach like this means for investors is that the returns in any individual year will never be extraordinary, but that over a lifetime of compounding, something of extraordinary value will be built. Would you invest? Obviously it depends on your time horizon and whether or not it matches Mr. Cucinelli’s.

Back to our aspirational consumer brand…

With a new investor that wanted to be out in less than 5 years, they mashed the pedal down on growth. Sales almost doubled the first year, and then doubled again. But gross margins dropped 1,200 basis points, profitability evaporated, and the business started to consume cash as inventory piled up on the balance sheet. Yes, you can achieve incredible temporary growth if you’re in-stock and slash prices.

And then the investor was back out in the marketplace trying to sell its stake at a valuation of 3x sales, believing it had earned 5x on its investment in just a few years.

Are you a buyer?

Running the numbers I could back into their valuation by assuming that the company could sustain its recent pace of growth while margins and the amount of inventory the company carried on its balance sheet reverted to previous levels. But that seemed to me an impossibility. Margin is one of the hardest metrics to recover in the marketplace. If you built your share on lower prices, your customer is not likely to stay with you when you raise them and raising prices is not something you can do when you have elevated levels of seasonal inventory. So what happens next is anybody’s guess.

My experience is that every company faces inflection points and that what happens next depends on what the organization is optimizing for. Very often what the organization decides to optimize for ends up matching what its investors are optimizing for. And while everyone says they’re a “long-term” investor, people define that term differently. This is why one should figure that out before taking someone else’s money and choose carefully before you do.

Are We Effed?

(4/5/23)

Brent (our founder) recently sent me a Twitter thread from someone who declared that we are effed. He knew a software developer in Pakistan who used ChatGPT 4 to study a hundred thousand Shopify sellers and then email three thousand of them each a plan for a unique custom app that it ideated that the software firm might build for them to improve their business. It was a massive, audacious cold email campaign and apparently it worked. The response rate was off the charts and in order to handle the volume, he also had ChatGPT 4 respond to the responses.

Minds were blown… The AI learned about the target company, learned about the capabilities of the software firm, brainstormed reasonably good ideas at scale, and then credibly interacted with other humans on specific topics.

After he sent me the thread Brent wanted to know (1) how we might employ similar capabilities to benefit our business and (2) what the endgame of widespread adoption of this technology might be.

With regards to (1) the answer is really any detail-oriented, repetitive task. For example, ChatGPT could be trained to look at company financials, identify red flags, and engage in initial due diligence over email, handling both initial questions and follow-ups, particularly if you helped it figure out what to look for. Now, you probably wouldn’t want it doing these things unsupervised, but if it could get you 90% of the way there, that would result in a significant efficiency level up.

Which brings us to (2)…

If you work online, you are about to get flooded with AI-generated solicitations. In fact, you probably already are (and Elon Musk already admitted as such). In fact, I kinda sorta suspect based on the tone that the original Twitter thread Brent sent me was generated by AI as well (and how meta is that?).

Being online is already a terrible place to be. Studies show that it’s bad for mental health and that it’s contributing to polarization. Moreover, my own experience is that the signal to noise ratio is deteriorating.

So what’s it going to be like when infinite bots are generating infinite content?

This is the dystopian turn our conversation took, but it ended on an optimistic note. In this world that may be nigh, the value of two very human qualities should skyrocket: judgment and authenticity. Judgment because in a world of infinite content it is going to be very valuable to be able to differentiate the good from the bad and the high potential from the low. Authenticity because in a world of infinite content the only content that anyone will respond to will be words that really resonate.

What’s more, are we going to become cynical and skeptical about who we think we’re interacting with? If you think it’s a bot on the other side, how likely might you be to engage? If very, what are you going to do?

We thought about that and wondered if it might drive people to deepen human, in-person relationships. You’ll reach out to the people you know and want to talk with them directly. Workers are already returning to the office in droves following a few years of unsatisfying remote work that many initially thought would be a boon for productivity and finding that they like it. It turns out we’re social creatures.

So whatever else happens with AI, if it puts us back in real world contact with one another, that would be a real benefit. And an improvement. And perhaps help us not be effed. Because judgment and authenticity matter.

P.S. This was written by ChatGPT 4.

P.P.S. Just kidding…but how might you tell?

The Circle of Sadness

(4/6/23)

One thing that a lot of people don’t know about me is that I cry during pretty much every Pixar film. In fact, I made the mistake of watching Up for the first time on a flight to Germany and was such a weepy mess just a few minutes in that the stoic Lufthansa flight attendants felt compelled to come check on me. I’m not sure why I’m sharing this other than this is the background you need to understand why one of the best ways to think about risk management comes from Inside Out.

If you don’t know the film, the premise is that all of us are run by competing emotions with distinct personalities inside our head with each of them “driving” at different times. When Joy’s in charge, for example, we’re happy. When Anger is, we’re mad.

The plot of the movie is that an 11-year-old girl moves from Minnesota to California and in doing so starts to be driven more and more by Sadness (which is what happens when one leaves the Midwest). Joy, however, doesn’t want to see that happen and does everything she can to stop Sadness from taking over, but in doing so sows chaos. It’s great entertainment.

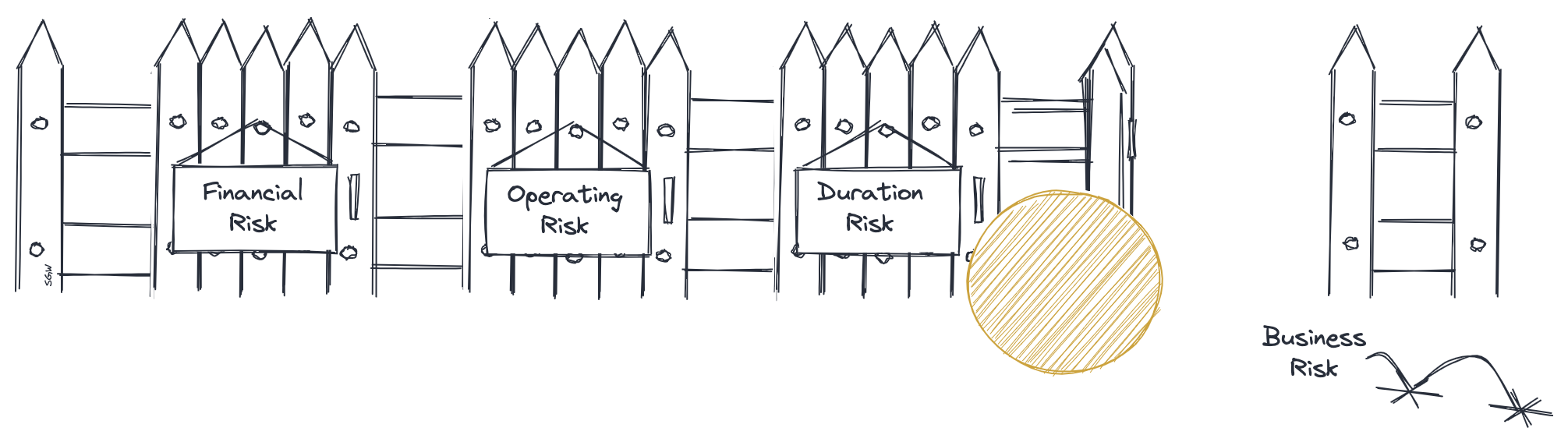

One iconic scene is when Joy draws a circle around Sadness and says that her job is to make sure all of the sadness stays inside of it. And that’s precisely how to think about risk.

See, when you’re taking risk, whether business or operating or investment or duration or whatever, you’re not going to walk away unscathed 100% of the time. What’s more, that arguably shouldn’t even be a goal because if you’re always right, it probably means that you are not taking enough risk. But if you know that you are going to be wrong or unlucky, then what’s critical is to make sure when you are, the consequences don’t overwhelm you.

For example, if you have a portfolio of real estate, it probably all shouldn’t be on the beach in Miami because if you’re wrong about hurricane risk, then you’re going to have a real problem. Or if you have a handful of businesses, they probably shouldn’t be guaranteeing one another’s loans because if one goes down it’s going to take the rest of them with it. Or if you have operating funds and emergency funds, you might not keep them in the same account at the same bank, just in case. Because if that bank fails, you’d lose access to your emergency funds at exactly the time you need them.

The term for this in high finance is ring-fencing, but ring-fencing applies everywhere. It’s the deliberate practice of acknowledging that bad things happen and therefore organizing yourself in such a way that when they do, it’s not game over.

Why More Banks Will Fail

(4/7/23)

A lot has been written about Silicon Valley Bank, Signature Bank, and the other financial institutions that failed or almost failed recently. People understandably want to know why that happened and who was responsible. And as I said on a recent podcast with Nikki (our CFO) and David (our creative director), there is a lot of culpability to go around.

My intent is not to rehash any of that here as better explainers have already been written. Instead it’s to build on an exchange that Emily and I had on Slack and that I tweeted about:

One of my favorite memos is the Lin Wells memo that Donald Rumsfeld shared with then President Bush in April 2001 ahead of the Quadrennial Defense Review. The point of the memo is that it’s hard to predict the future and that big changes can happen in short periods of time, so plans should be adaptable and not assume that anything will stay the same. The timing of the memo is evidence of that as well as five months later September 11th happened and the world changed again.

What does this have to do with banks failing?

A common thread across the banks that failed is that they assumed (1) that interest rates would stay low and (2) that depositors wouldn’t all ask for their money back at the same time. Assumption (1) was naive on its face, but to be fair rates until recently had hovered near zero for almost 15 years. And if you can’t assume (2), well, you can’t reasonably operate as a bank. So I understand why mistakes were made.

Regulators won’t want to read this but regulation is inherently narcissistic. It means that you think you reasonably know what might happen before it does and can write rules to prevent it. But as the Wells memo demonstrates, we often don’t know anything about even really big things before they happen. But to Emily’s point, rulemakers can’t also be constantly reactionary, deciding what’s allowed and what’s not ex post facto. That’s the Calvinball approach (shoutout Bill Watterson) and it wouldn’t work either!

How can these ideas hang together? The answer is they don’t. And that’s why, whether now or in the future, more banks will fail and other bad things will happen because we didn’t know what to prepare for.

Have a great weekend.

Want Unqualified Opinions delivered to your inbox every weekday?