Volatility and Durability: 2022 Mid-Year Update

Things have gotten bumpy again, as they always do. War, inflation, tightening monetary policy, labor availability, inconsistent production in Asia, and other supply chain issues have created a volatile mix of inputs. Debt is more expensive and harder to get. Demand remains shockingly high for some products, while for others, it is in free fall. An uncertain political environment and erratic government policy amplify it all.

We think a lot about durability. Good times and bad times will come and go, often faster than we expect. Periods of peace and prosperity never last. Human nature’s beauty and brokenness are universal constants, assuring that we will have times of pessimism and excess.

And yet, small businesses run by thoughtful operators will always need to be stewarded. Time waits for no one. Owners get sick and burn out with no regard for economic cycles, monetary policy, or the spreadsheet math of investment firms.

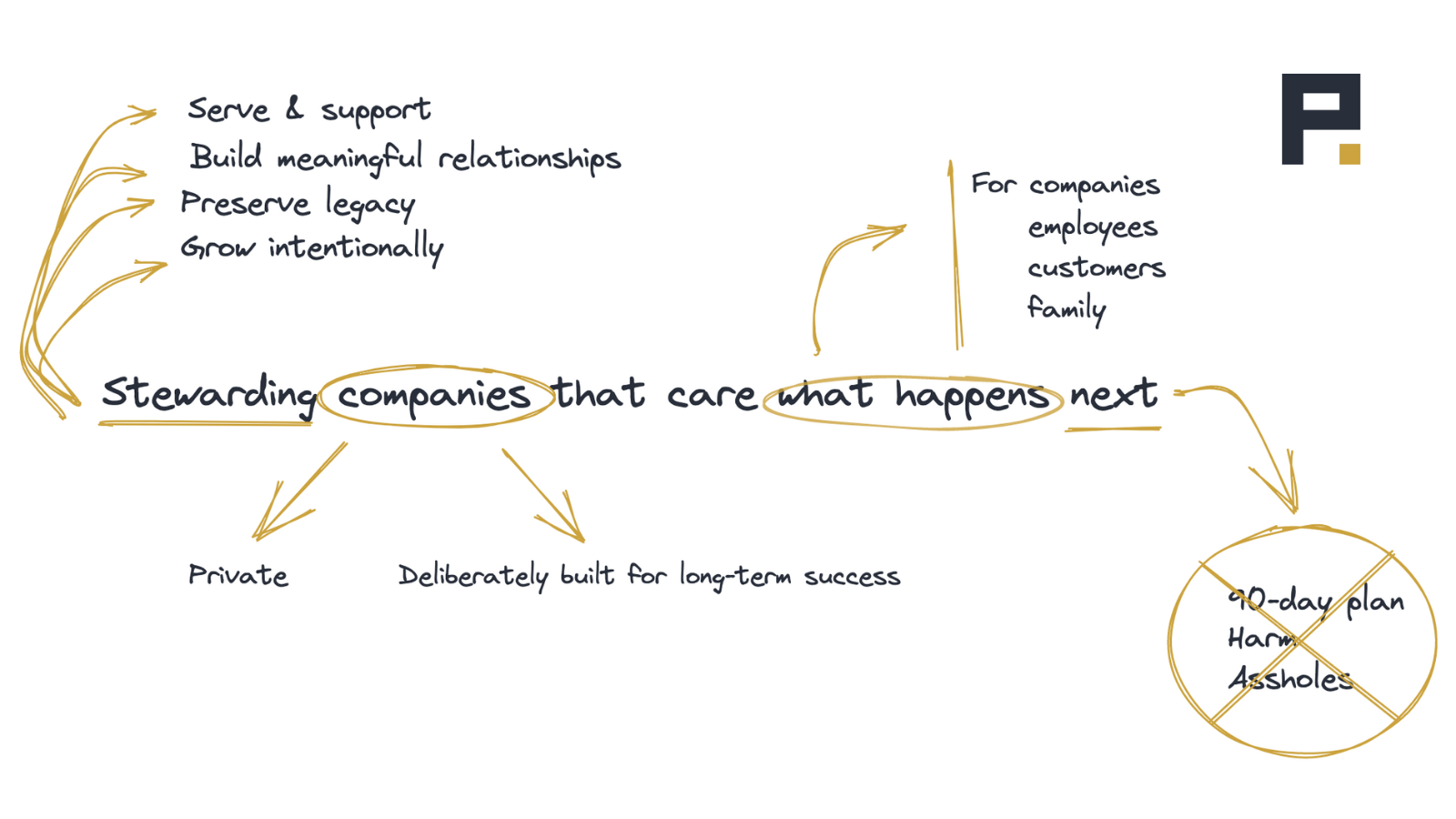

How do you steward businesses that care what happens next, which effectively means they are conditioned to operate successfully in a wide range of conditions? For Permanent Equity, it looks like low-to-no debt, striving for humility in our attitude and underwriting, and a 30-year time horizon.

The last three years have been a fantastic environment for private equity and a tough environment for Permanent Equity. Debt cost has been at nearly zero, and our peers love to lever up. Fundless sponsors seemed able to raise unlimited amounts of money from LPs unconcerned with much beyond the transaction. Exit multiples have been expanding rapidly, creating Excel models that justify ever-increasing prices. With so much money sloshing around, most investment banks forced processes that were designed to maximize the financial outcome, while overtly avoiding the development of any relationship between a buyer and a seller. And, most buyers didn’t mind, because they weren’t going to hold the investment long-term anyway.

It’s hard to argue against short-term, perpetually optimistic thinking when, frankly, it has been damn profitable for a very long time. As one of the best investors I know said about six months ago, “If you look at the most successful investment firms of the past 10 years, they paid up and almost universally got paid well to do it.”

We started experiencing a change about 6 months ago, but have no clue if it’s a temporary shift or a more structural one. Our offers, which didn’t go up with everyone else’s and won’t go down if others’ do, have gotten more competitive. Bankers seem more concerned with quality of capital and are far more flexible on process. And, some of the new-to-the-game competition is finding operating businesses harder than they expected.

We remain focused on playing our game, which suddenly feels like the game everyone is trying to play. Here are a few updates across the three pillars of our business – capital, talent, and opportunities.

CAPITAL

We continue to invest Permanent Equity II, a 30-year, $300 million fund raised in December 2019. As investors, not capital deployers, we told our LPs that we may invest all of the fund in one year or none of it for quite a few years. And with our unique fee structure and 10-year investment period, our incentives are perfectly aligned – we should do good deals and not do bad deals. As simple as that sounds, it’s pretty rare in the we-buy/deploy-vintage-of-fund private equity world. For that patient alignment, we’re grateful.

Smart people with long track records warned us about taking outside capital. They said it would screw up our decision-making and generally be a pain. For most, that is a fair warning. But for us, outside capital has been a Godsend. Five years in, and we’re doing the same thing we did 5 years ago, but have learned a few things, improved our systems, and built a better team. We enjoy and appreciate our investors. They’ve been kind, generous, and helpful, seriously without exception. Maybe our weird structure was a sorting hat, creating a fantastic selection bias? While we can’t be certain, we’re certainly thankful.

The only unexpected factor has been how often we’re asked by larger family-owned businesses to get involved. And, it’s happening more often recently. Our approach is rare in the lower end of the lower-middle market, but it’s even more unusual upmarket. As one owner told me recently, “If you don’t want to sell out to private equity or get subsumed into a strategic, there are very few places for a $15M-$50M FCF family-owned business to go get liquidity.” The more we’ve examined it, it seems like ESOPs are a popular choice. ESOPs can be a great tool, but also present challenges with incentives, governance, and decision-making, especially long-term. We’re not sure where these conversations go, but it is on our mind.

TALENT

Google the phrase “The Great Resignation.” COVID caused a realignment economically, socially, and geographically. Personal and professional volatility, heavy government intervention, and disrupted routines, paired with newfound freedom for the white collar email class, have led to the most chaotic labor market in recent history.

Thankfully, our family of companies has been largely spared, a testament to their strong cultures and leadership. A curious trend is that smaller organizations seem to be increasingly attractive. Perhaps there’s a craving for professional connection that comes easier with smaller teams? Maybe it's because, on average, small businesses have returned to “normal” more quickly? Either way, it has been a trend that we’ve enjoyed. Several of our companies made decade-strides in months, bringing on incredible talent that otherwise would have been impossible. And now, we’re enjoying the fruits of it.

At Permanent Equity, we also have been planning for and building towards the future, with several new and notable hires. Here’s the rundown:

Ryan Lidolph, Operating Partner

We’ve been trying to hire Ryan for over 7 years, which is the amount of time that we’ve had the pleasure of working with him as he rose in the banking world from a commercial lender to a bank president. Since day one, Ryan brought a level of thoughtfulness, problem-solving, creativity, and rigor that we had not previously experienced in the banking industry. He always did what he said he was going to, when he said he’d do it. We knew that we wanted to work more closely with him and he gave us the polite brush-off for, well, longer than we would have liked. Finally, we wore him down and he agreed to join the team. He’s incredibly experienced with small company operations and finances, which makes him perfect to work with our portfolio to build strategy, solve problems, and figure out how to help them grow.

Johnny Fugitt, Director of Portfolio Operations

All businesses are loosely functioning disasters that sometimes happen to make money. And the smaller they are, the more loosely they function. We’ve long thought about building up an internal consulting practice that could be a more specialized McKinsey or Bain Consulting, with aligned incentives, and staffed exclusively by people who care deeply about helping family-owned and operated businesses. In fact, we had decided to start looking for someone to lead this effort when, lo and behold, Johnny appeared. His background at BCG and military experience as an officer gives him the cross-discipline training to identify and shepherd critical projects. His role is as a change-agent to improve the quality and quantity of earnings through de-risking the businesses and increasing their upside. And, Johnny and his wife moved from Miami to Columbia, MO. In the battle for talent, notch a victory for team Midwest against the seemingly undefeated Mayor Suarez.

Sarah George-Waterfield, Managing Editor & David Cover, Creative Director

There’s only one way to scale conversations – content. It has been a critical ingredient in our ability to attract the right investors, sellers, leaders, and teammates. But as we’ve grown and gotten “real jobs,” we’ve struggled to express ourselves with any regular cadence. And while we preach the value of it, alas, the cobbler’s son is left without shoes. It became obvious that we needed to invest in people who are more talented, more thoughtful, and more focused on helping us share.

Hiring for content is a risky proposition: how could we build capacity without losing our voice? We write like we talk. And we think we’ve been able to connect with people through our writings because it sounds genuine… because it is. So, we looked far and wide, eventually finding two people who get us, are us, and can deliver on behalf of us.

Sarah has a PhD in English, with technical capacity the rest of us only aspire to. David has over a decade of experience as an audiovisual storyteller and editor. Neither have a background in private equity and both have familial ties to small business. Together, they are working to explore, build on, and express the team’s experiences, ideas, points of view, and personalities. If there’s something you’re curious about, or an area of investing or operating that you’d like us to discuss more, drop them a line.

All of our recent hires are growth-oriented, a long-term investment in building capacity and capabilities. But more importantly, at a personal level, these hires also all felt natural, with shared enthusiasm about supporting smaller organizations, an earnest desire to intentionally contribute, and a deeply relational approach.

If you’re interested in knowing about open positions now or in the future, we encourage you to register for The Orbit. We greatly value the coffee and lunch dates enjoyed over the past months with those already in the network and look forward to many more in the months ahead.

INVESTMENT

One of our favorite concepts in investing is the “value curve” – quality of investment on the X-axis and price on the Y-axis. Almost all investors, including us, started on the bottom left corner, because price is the easiest thing to detect. Often, the question in that area is, “Is it cheap?” As you move towards higher quality, price tends to rise, but non-linearly. The need for skill increases, because assessing quality is infinitely more complex than analyzing an income statement and balance sheet. As you move up the curve, the opportunity presents as a proper analysis of quality paired with a price that doesn’t appreciate it.

Things are almost always cheap for a reason, with some obvious defect or risk. If it’s cheap, it’s usually because the business model is suboptimal. Sometimes this looks like capped upside, unlimited downside, as is the case, for instance, with construction sub-contractors. If a project goes perfectly, you know how much you’ll make. Of course, things never go perfectly. How much could you lose if a project really goes south? That’s limited only by the bankruptcy protection laws and is why construction firms often transact at low multiples of earnings.

On the other end of the spectrum is software, which is now widely recognized as the best business model. It’s infinitely scalable with nearly 100% operating leverage and 100% gross margin. This hasn’t always been the case, but it’s now also often priced accordingly. In the past, we didn’t seriously consider most software-based businesses, both because we lacked the proper skill and because of price. But as we’ve gained more experience and added talented team members who come with technical backgrounds, we’re starting to look at more business models that mix in software. With that said…

We’re excited to announce our newest investment and partnership with the team at AdAdvance. It’s a different style of investment for us. The Duluth-based team specializes in Amazon-oriented advertising and sales optimization, using custom-developed software. They’re technically excellent, with a proprietary code base to prove it. And as Amazon has grown as an ad platform, demand for their offerings has exploded.

Matt and Joe are the founders, a developer and an organic chemist by trade, respectively. They set out looking for an investment partner to support scaling, but did not want to lose their culture, value proposition, or autonomy. They have a long runway as operators, are independently successful, and didn’t have to do anything, providing the ultimate relationship test.

A tech-based marketing firm is certainly a shift for us, but beyond the headline, there are a lot of similarities. Quite honestly, Matt and Joe had questions about our interest and potential fit at first. But the more we talked, the more the fit became obvious. They know and love what they do, and have built a team in kind. What they need to accelerate growth is familiar to us, and to virtually all businesses at their stage – more robust systems, talent recruitment, business development, and help scaling.

We’re thrilled to be their partners and are excited about the road ahead, even in the winter months. Rest assured, we’re also investing in appropriate gear for ice fishing.

If your brand invests in advertising, we’d love to help you start a conversation with AdAdvance. They work with both e-commerce sellers and general brands looking for reach. Ping us and we’ll get you routed appropriately.

OPEN DOOR

We continue to be extremely optimistic long-term about the future for smaller organizations, American commerce, and a patient approach. We’re unabashedly proud of small businesses, their owners, and their employees for serving customers and communities with deep conviction and loyalty. You’re the reason we exist. We have a ton of fun doing what we do, and don’t take any of it for granted.

That said, we’re conscious that the past couple of years have been an intense workout for most operators, whether or not you actually wanted to be in shape. Many conversations this year have centered around the lack of stability. If it’s not this, it’s that, and almost no one is spared. Especially for operators, we know it can be lonely, stressful, and just plain exhausting. Such a burden can understandably cause you to close the door to outside help, new relationships, and new possibilities.

The word of wisdom we would humbly offer up is to continue to keep your door propped open. It’s easier to be kind when everyone is winning. But stronger bonds are built in tougher times, and growth always comes from hardship, personally and professionally.

No one is truly alone unless they choose to be. We’re open to be vented to, to be asked of, and to be engaged in challenging situations, even if that’s just being an ear. We’ve received many generous offers of help and support and wisdom from experience. We hope we can pay it forward and offer the same to you.

And, as always, if we can be helpful along the way, please reach out.

To receive updates like this one in your inbox, subscribe below.