The Five W’s of Deals

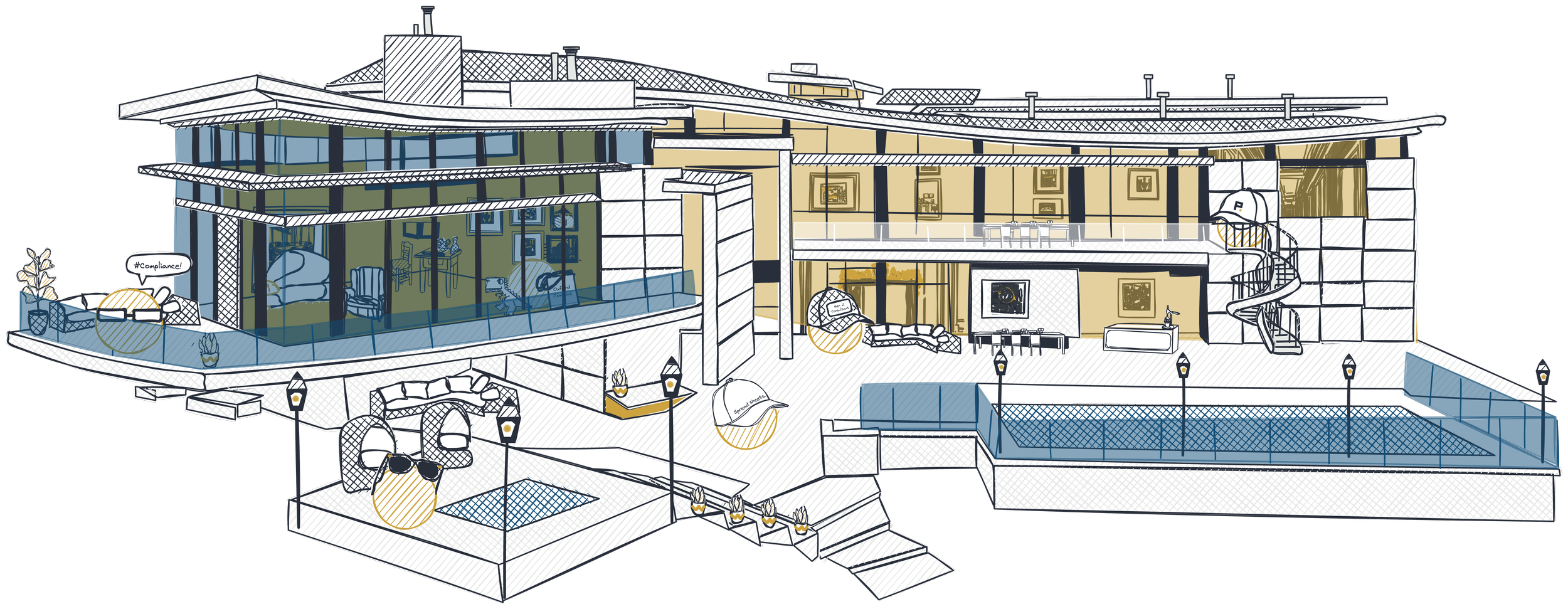

One of my guilty pleasures on the weekend is to peruse the outrageous luxury homes featured for sale in The WSJ’s real estate section. Yes, they are mostly over the top, but it’s also fun and interesting to see some of the incredible places others have discovered and designed in this world.

There aren’t many (any?) repeats in that section, so imagine my surprise when I saw Ledgerock earlier this year. “That looks familiar,” I thought to myself. And sure enough it was. The same property had been featured in the same place a little more than three years prior.

Here’s the kicker though. Three years prior the property was listed for sale by its owners for an eye-popping $45M. Today, however, you can purchase it from a litigation finance firm for a somewhat less eye-popping $11.25M (here’s the Zillow listing should you be interested; if you close, please invite SarahGW and me to the housewarming).

But is that a good deal? Here are some markers to help us figure that out:

The previous owners purchased the property 20 years ago and because there were pre-existing structures on the lot, were grandfathered in to build adjacent to the river whereas anywhere else would have 100 foot setback requirements (so you can make the argument this is an irreplaceable asset).

It’s estimated that it would cost $30M to $40M to build the same house today, so you’d be getting a massive discount to replacement value.

It has a car wash, so you could presumably split that asset off and sell it for 20x EBITDA to a private equity firm doing a roll-up and make back your purchase price right there.

In other words, $11.25M does seem like compelling value if you happen to have that kind of money and are looking for a pied-a-terre in upstate New York.

That said, how does a one-of-a-kind piece of real estate lose 75% of its value in three years? The answer to that speaks to the difference between spreadsheet value and real world value when it comes to transactions and also to the fact that you should have a strong understanding of the Five W’s (who, what, where, when, and why) before doing any sort of deal.

See, three years ago the long-term owners who constructed the home were selling it in an unhurried process in order to free them up to travel more to see their grandchildren. Today, a litigation finance firm that “took title to the property” after the previous owner defaulted on a $13M loan from them (“took title” is doing a lot of heavy lifting there) is trying to get rid of something they probably never wanted in the first place in order to recoup a hefty loss.

It’s not rocket science to see that it will take a lot more money to find a cross in one of those scenarios than the other. In other words, while what or where something is may typically be considered the driver of its intrinsic value, the terms on which a deal actually gets done will likely hinge more on who is transacting, when, and why.

So maybe we should opportunistically make Ledgerock the site of Permanent Equity East? Plus, it’s the cheapest platform for a car wash roll-up I’ve come across.

– Tim