Build a Better Small Business Budget For 2023

In early 2020 we published an essay called “Build a Better Small Business Budget.” While initially drafted prior to the onset of the Covid-19 pandemic, we thought it was a timely piece to publish given all of the uncertainty – financial and otherwise – then in the world. We concluded that “better days lie ahead and a plan will help see you through to them.”

As the world spins toward 2023, we know a lot more about Covid-19, but uncertainty remains. New challenges – inflation, supply chain disruptions, labor shortages – have been layered on top. Some businesses and industries have seen incredible tail winds through the pandemic and are wondering if recent sales and earnings momentum will continue or if a slowdown is coming (or is already here).

All of this is to say that while it’s always good to have a plan, 2023 strikes us as a year when every business, large or small, struggling or booming, should have a thoughtful outline to keep on top of performance and understand where there might be risks to or opportunities for the bottom line.

What’s Changed and What’s the Same

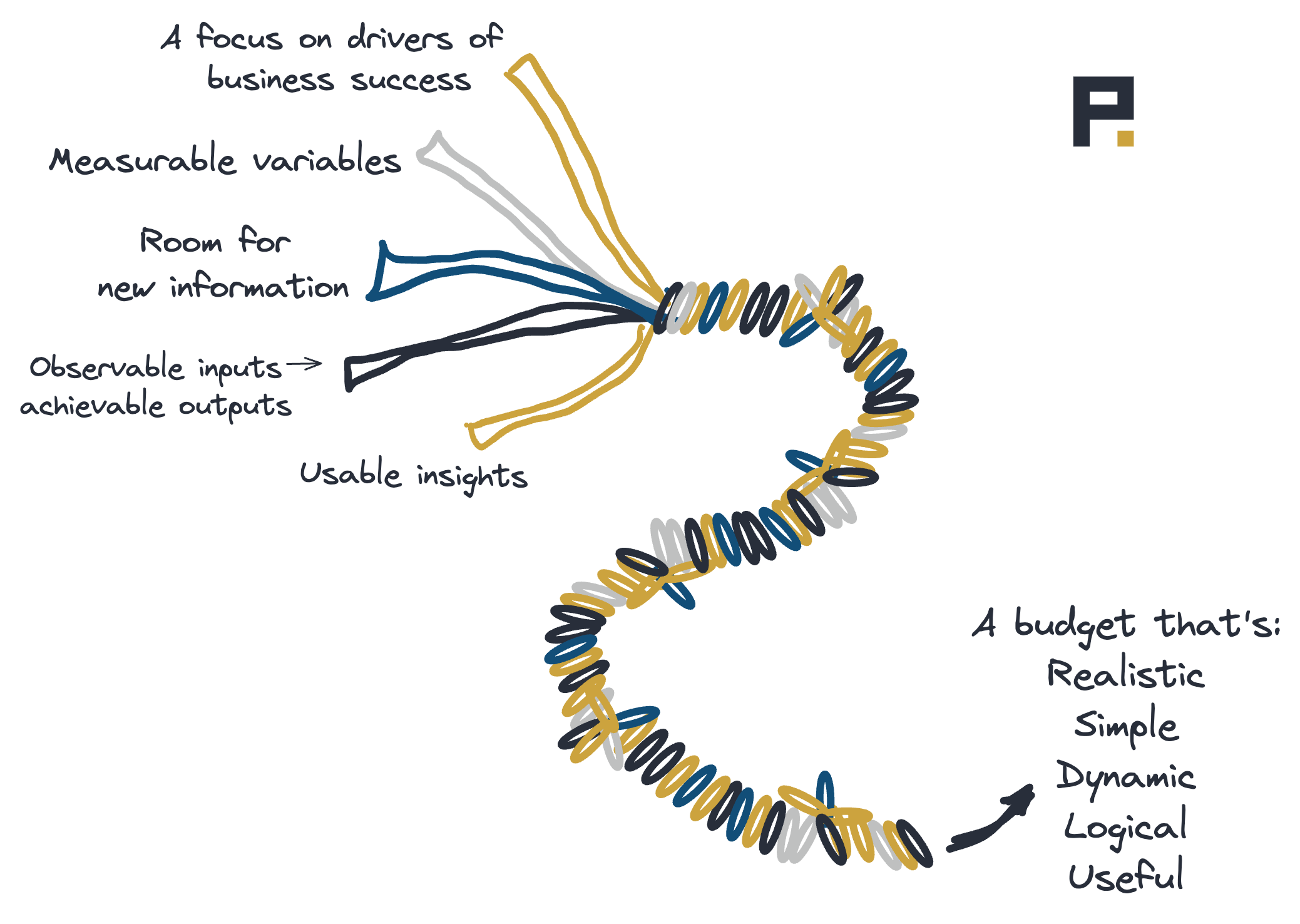

As a reminder, the bedrock principles of any company’s financial plan are that it be:

Realistic – achievable outputs based on observable inputs

Simple – easily explained and understood

Dynamic – adaptable to changing circumstances

Logical – derived from measurable variable that build on one another in straightforward ways

Useful – able to be used by employees making everyday decisions

You can (and should) read the original essay for how we think you can build a budget that achieves those objectives. But what makes this a difficult time to pick the flavor of budget that might be worth building is the enormous amount of possible variance in even the most basic assumptions.

Here is a sampling of questions that are critically important to some of our businesses where the answers are polar opposites, but it’s a coin toss as to what happens next.

Are we in a recession or not? If yes, why is unemployment so low? If no, why does consumer demand seem to be slowing?

Are interest rates going to rise or fall sharply? We can’t remember a time when both options seemed so obviously on the table.

Should we order a lot of inventory (demand will be there/the supply chain will stay disrupted/production costs will not go down) or very little (demand will be weak/the supply chain is getting fixed/input costs have to drop from here)?

Should we manufacture onshore or off?

Should we be optimizing for margin predictability or margin volatility?

Are the capacity constraints we’re experiencing helpful or limiting? For example, if we’re operating near physical capacity, should we be investing in more space? If you diagnose the current utilization as unusual and can enjoy outsized margins in the interim, the answer is probably no.

Based on industry positioning and pricing, are we in an offensive or defensive posture? How would we win over a competitor’s customer? Why would we lose one of our own?

If you think we’re in a recession and interest rates will rise, you should order less inventory and plan on moving manufacturing onshore. If you think we are not in a recession and that rates will fall, you should order a lot of inventory and leave manufacturing overseas. If you turn out to be wrong, you will likely have a terrible 2023 and end up spending years to reverse course and catch up to the competition.

In other words, this is hard, high stakes stuff. And how things play out is unknowable.

It’s for that reason that the budgeting element to focus on now is how to make it dynamic. That means it’s easily updated, adaptable to changing circumstances, and able to accommodate a wide range of inputs, while still generating actionable, useful information.

Easier Said Than Done

Our collective operating experience has taught us to be strong believers in the Pareto principle. This is the concept that “80% of consequences come from 20% of causes.” But it may be closer to 90% coming from 10%. If you’re able to identify the most important elements that drive your business and get them right, you should do at least okay, even amid uncertainty and volatility.

How does this apply to budgeting?

At the risk of oversimplifying, business operations can be broken down into a series of math problems composed of independent variables. Your profit is your revenue minus your costs. Your revenue is your selling price times your volume. Your volume is your leads times a conversion rate. Your costs are your inputs plus your people. And so on.

While it’s true that some of these variables can influence one another (for example, if your input costs are higher, your conversion rates might fall), it’s worth the time to break out all of the meaningful, independent contributors. From there, look at the historical data. What’s the highest something has been and what’s the lowest? Is it better to look at it as an absolute value or as a percentage of something else? How volatile has it been and is it likely to be more or less volatile going forward?

As you think through each of these inputs our experience is that you will find some to be very stable and predictable and others to be volatile. What’s more, usually nothing is always all the best it’s been or the worst it’s been at the same time (i.e., if you are planning on raising prices you probably shouldn’t also forecast record volumes).

What to Do Next

At this point you should have three things that will form the foundation of your plan:

A list of the financial building blocks of your business.

A range of where they have been in the past and a sense of how much they change.

An understanding of how they play together.

The next step is to put everything together in a spreadsheet. For example, here’s a simple budget for Hypothetical Small Services Business LLC:

It contemplates a business that will sell 500 units per month at $500 per unit paying $10 per lead and buying 10,000 leads that convert at a 5% rate. Aside from marketing costs and $25,000 in stable monthly overhead, it pays 5 employees $75,000 per year to each service 100 units per month. This has the business netting $1.125mm on $3mm of revenue.

Is this a realistic plan? What we like to do next is compare our budgeted key assumptions against past performance and volatility. That can look like this:

In this simple example we have some refining to do, but broadly we have a reasonable plan compared to historical performance. Further, there may be good reasons for optimism or pessimism and leaving those assumptions as is. You might expect employees to be out sick, which would hurt productivity. Or maybe you know you just laid off an overpaid underperformer and that cost per employee will come down. The key is to examine all of the assumptions and agree they make sense.

But It’s Never That Easy

This piece kicked off with a long discussion about the likelihood of variance and volatility heading into 2023. No business reality is likely to be as simple and straightforward as Hypothetical Small Services Business LLC. Here’s where knowing the highs and lows and how the different variables interact can be helpful.

Let’s suppose, for example, the historical cost per lead range is actually $8 to $30, having recently skyrocketed. While the consensus may be that costs will revert, there’s a chance that CPLs stay elevated. If you assume $30 CPLs for HSSB LLC, the business model breaks and it loses more than $1.2mm. But since CPL is an external factor on which the business can have no influence, at least now you have a way to tinker with the business model to see if you can project to acceptable performance.

Here, for example, is HSSB LLC eking out $400k of profit by acquiring half as many leads, converting them at 9%, asking employees to handle 175 units per month and cutting overhead to $20k per month. Is that acceptable performance? Ultimately that’s for the owner to decide taking into account the likelihood of this scenario occurring, what tradeoffs the business is making for the future, and whether the new set of key assumptions is reasonable.

The good news is that there is a path forward and measurable items that the CEO can compare performance against in order to continually update the assumptions. If, for example, the CPL stays at $30 but conversion doesn’t improve despite acquiring fewer leads, that may be a sign to further reduce headcount or explore new ways of acquiring customers.

Running a business is hard and running a business in an environment with so many challenges is even harder. But if you build a forward-looking budget like this one, it can help you break down that uncertainty into its component parts and help a business diagnose and fix potential problems or bad assumptions before they torpedo the entire year.

All of that said, not all planning can fit in a simple template like this one. Here is some guidance on other practical questions we see a lot:

The business wants to make a big bet that won’t pay off for several years. How should I think about that?

Before making the bet, you need to answer two big questions: how am I paying for it, and how long will it take to pay me back? Your options on how to pay for it are to reserve cash ahead of time, pay for it as you go through cash flows from the core business, or take on outside funding in the form of a loan or an investment. The pros and cons of each of these approaches are the subject of another (long) article, though many of the tradeoffs are readily apparent.

Next, you need to determine how long it will take to pay you back. To answer this question, we’ve found it helpful to repurpose the same model you’ve used to build the budget for your business. Copy that tab, set all the inputs to zero, then model out this initiative as if it were its own business. When will revenues start to come in? What will the input costs be for the product or service? Will you need to hire more overhead to manage this new initiative? Acquire additional third-party help? Building this new business from the ground up is a good way to keep yourself honest about what it’s going to take. Your model will now show you not only how long it will take to break even, but you can also add up the shortfalls you need to cover in the meantime. This information can be key to answering the first question of how you’re going to pay for it.

The business is making money but short on cash because my customers won’t pay on time. What should I do?

We know CEOs who entirely outsource AR collection and others who consider collecting overdue payments one of their biggest value-adds to the business. The right way is “whatever works.” Cash is critical to the smooth operations of a business and, during times of uncertainty, you can’t let your business become a bank for others (which is what happens if your customers aren’t paying you but you continue to pay your people and suppliers). It can feel bad to be the bad guy, but turnabout is fair play provided you have given your partners plenty of notice about what is happening and why. If you’re in construction and your supplier is going to put you on a credit hold because you haven’t been paid by the GC, you may need to get more aggressive and lien the project. That can feel risky, particularly when it comes to larger customers, but our experience is that it is always better long-term to stand up for the economics of your business and not get taken advantage of.

Getting aggressive about collections is far easier if you’ve laid the groundwork of being a great long-term partner. If you’ve proven that your business does what it says it’s going to do, then collecting when you said you were going to just means you’re a consistent partner.

What if things go really badly? What are my options?

The planning here depends on how long it takes to figure out if your business is going off the rails and then how long it might take to put it back on the rails. We typically think six months is a reasonable period of time to identify that something is going wrong and gather evidence about whether your attempts to fix it are working. To that end, we like to have access to about six months of cash expenses through a combination of cash on the balance sheet and undrawn capacity on a line of credit. This means one could keep a business running for six months without revenue (longer than that and you should probably just shut down the business; shorter and you may miss an opportunity to make a strategic fix). If a bad situation is going to last longer than that and you need to take cost out of the business, a key question to ask is how long demand will be impaired. If permanently, take excess costs out of front line production. If temporarily, keep front line production well funded and take costs, at least temporarily, from highly compensated employees and activities with longer payback periods such as business development. If everyone is aligned around an eventual recovery and the organization just needs to get through to the other side, we have seen success in PIK approaches, where employees agree to forego costs and benefits in order to recoup them later (with a promised excess return) when the business is in a position to pay them.

Admittedly, this is all one big moving target. The value in building a budget and adapting it to circumstances as they change is in thinking about present and future value and optimizing for both at the same time.

Want more tactics and plays delivered to your inbox? Subscribe to our newsletter for operators, Permanent Playbook.